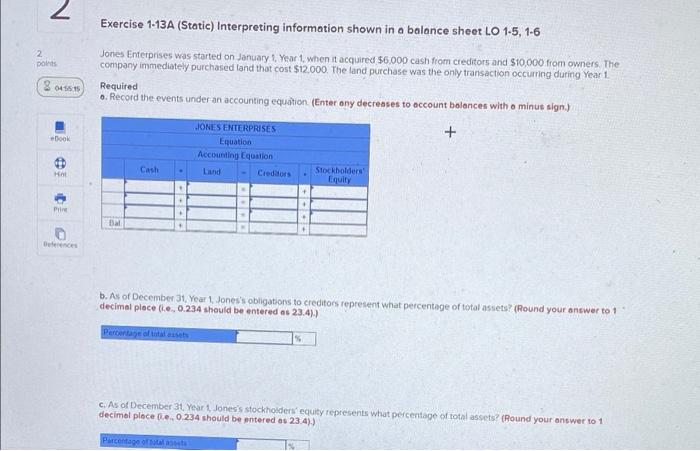

Question: 2 Exercise 1-13A (Static) Interpreting information shown in a balance sheet LO 1-5, 1-6 2 points 80455 Jones Enterprises was started on January 1 Yeart

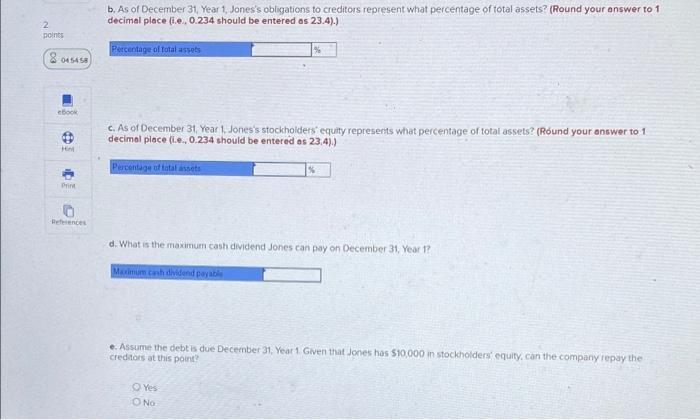

2 Exercise 1-13A (Static) Interpreting information shown in a balance sheet LO 1-5, 1-6 2 points 80455 Jones Enterprises was started on January 1 Yeart when it acquired $6,000 cash from creditors and $10,000 from owners. The company immediately purchased and that cost $12.000. The land purchase was the only transaction occurring during Year 1 Required o. Record the events under an accounting eqution (Enter any decreases to account balances with a minus sign) JONES ENTERPRISES + Equation Accounting Equation Cash Land Credors Stockholders Equity Dook Hot + Print . Bal + ce b. As of December 31, Year Jones's obligations to creditors represent what percentage of total assets? (Round your answer to 1 decimal place the 0.234 should be entered as 23.4).) Percentage of titlust c. As of December 31 Yeart Jones's stockholders' equity represents what percentage of total assets? (Round your answer 101 decimal place be 0.234 should be entered os 23.4%) Parcentage of b. As of December 31 Year 1, Jones's obligations to creditors represent what percentage of total assets? (Round your answer to 1 decimal place (ie, 0.234 should be entered as 23.4).) 2 points Percentage of total assets 804545 cbook c. As of December 31, Year 1 Jones's stockholders' equity represents what percentage of total assets? (Round your answer to 1 decimal place (.e., 0.234 should be entered as 23,4).) Percentage of total assets Print -Retriences d. What is the maximum cash dividend Jones can pay on December 31, Year 1? Maximum cash dividend payable e. Assume the debt is due December 31, Year 1 Given that Jones has $10,000 in stockholders' equity, can the company repay the creditors at this point Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts