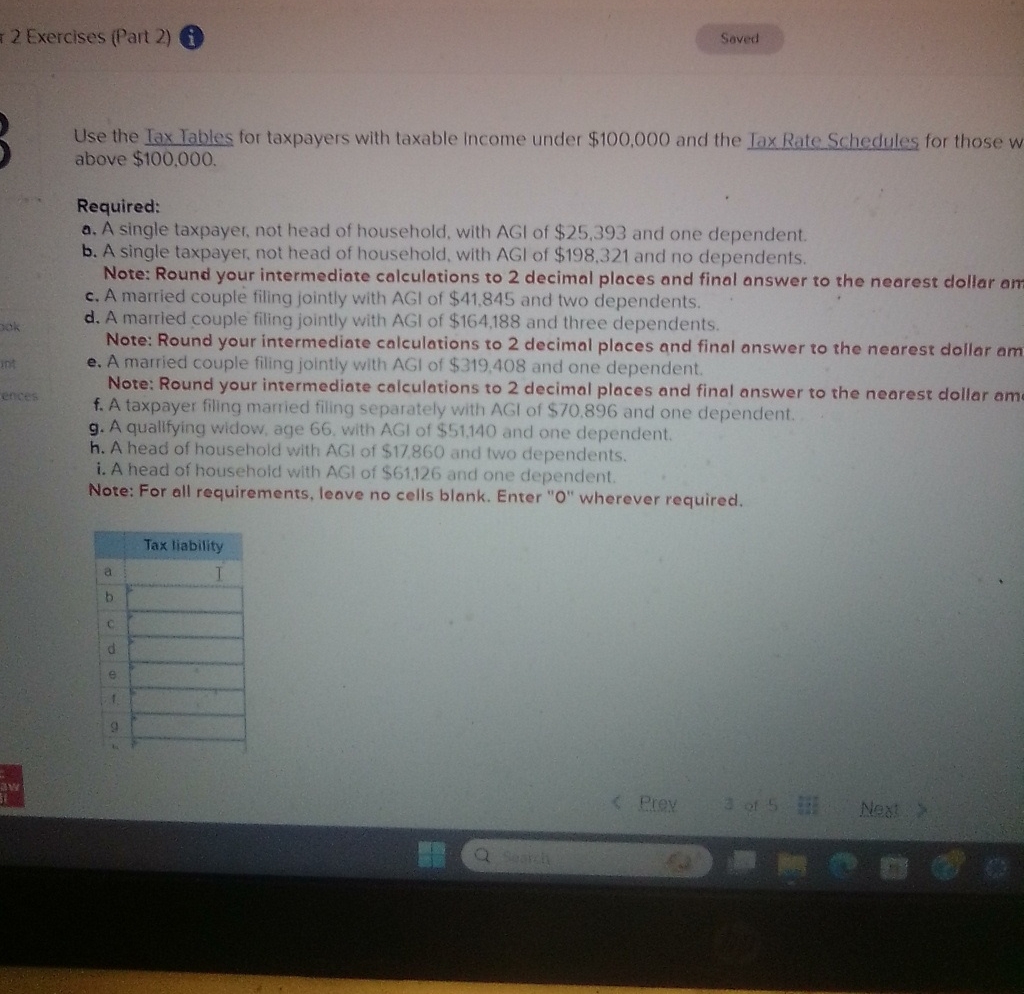

Question: 2 Exercises ( Part 2 ) Use the Iax Tables for taxpayers with taxable income under $ 1 0 0 , 0 0 0 and

Exercises Part

Use the Iax Tables for taxpayers with taxable income under $ and the Iax Rate Schedules for those above $

Required:

a A single taxpayer, not head of household, with AGI of $ and one dependent.

b A single taxpayer, not head of household, with AGI of $ and no dependents.

Note: Round your intermediate calculations to decimal places and final answer to the nearest dollar am

c A married couple filing jointly with AGI of $ and two dependents.

d A married couple filing jointly with AGI of $ and three dependents.

Note: Round your intermediate calculations to decimal places and final answer to the nearest dollar am

e A married couple filing jointly with AGI of $ and one dependent.

Note: Round your intermediate calculations to decimal places and final answer to the nearest dollar am

f A taxpayer filing married filing separately with AGI of $ and one dependent.

A qualifying widow, age with AGI of $ and one dependent.

h A head of household with AGI of $ and two dependents.

i A head of household with AGI of $ and one dependent.

Note: For all requirements, leove no cells blank. Enter wherever required.

tableTax liabilityaIbcde

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock