Question: 2.) Explain how an increase in expected inflation and increased risk aversion impact the market security line (SML). PLEASE SOLVE THESE BOTH QUESTIONS ASAP!! REALLY

2.) Explain how an increase in expected inflation and increased risk aversion impact the market security line (SML).

PLEASE SOLVE THESE BOTH QUESTIONS ASAP!! REALLY NEED HELP! THANK YOU:)

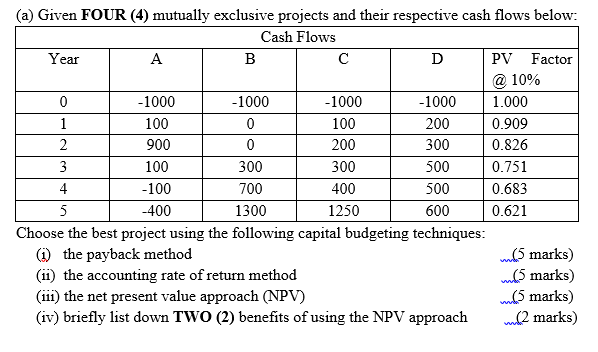

(a) Given FOUR (4) mutually exclusive projects and their respective cash flows below: Cash Flows Year A B D PV Factor @ 10% 0 -1000 -1000 -1000 -1000 1.000 1 100 0 100 200 0.909 2 900 0 200 300 0.826 3 100 300 300 500 0.751 4 -100 700 400 500 0.683 5 -400 1300 1250 600 0.621 Choose the best project using the following capital budgeting techniques: the payback method 5 marks) (11) the accounting rate of return method m5 marks) (111) the net present value approach (NPV) m5 marks) (iv) briefly list down TWO (2) benefits of using the NPV approach ml2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts