Question: 2. Fill out the table below. (80 points) The first three columns are inputs. P and CR are, respectively, the price and coupon rate of

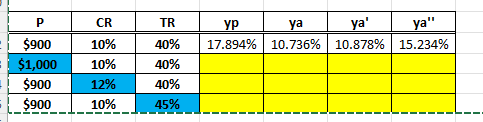

2. Fill out the table below. (80 points) The first three columns are inputs. P and CR are, respectively, the price and coupon rate of an annual 1.5-year coupon bond. TR is the marginal tax rate. The face value is $1,000. The last four columns are outputs. yp is the pretax yield. ya is the after-tax yield implied by the potentially-flawed formula. ya' is the after-tax yield assuming capital gains are only taxed at maturity and coupon payments are taxed normally. ya'' is the after-tax yield assuming capital gains are only taxed at maturity and coupon payments are tax-exempt. I have already filled out the first row; it is the example we worked through in class. The goal for this exercise is to see how these yields change as the inputs change.

\begin{tabular}{|c|c|c|c|c|c|c|} \hline P & CR & TR & yp & ya & ya' & ya' \\ \hline \hline$900 & 10% & 40% & 17.894% & 10.736% & 10.878% & 15.234% \\ \hline$1,000 & 10% & 40% & & & & \\ \hline 900 & 12% & 40% & & & & \\ \hline $900 & 10% & 45% & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts