Question: - + 2 fit to page Page View A Read aloud Award: 10.00 points You are called in as a financial analyst to appraise the

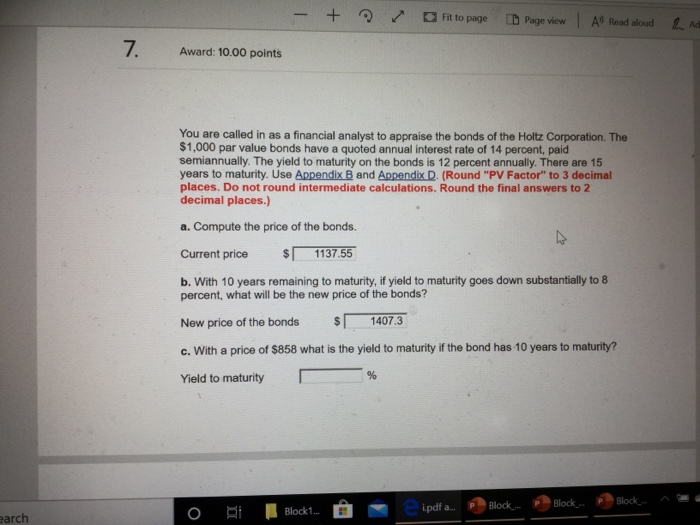

- + 2 fit to page Page View A Read aloud Award: 10.00 points You are called in as a financial analyst to appraise the bonds of the Holtz Corporation. The $1,000 par value bonds have a quoted annual interest rate of 14 percent, paid semiannually. The yield to maturity on the bonds is 12 percent annually. There are 15 years to maturity. Use Appendix B and Appendix D. (Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Compute the price of the bonds. Current price $ 1137.55 b. With 10 years remaining to maturity, if yield to maturity goes down substantially to 8 percent, what will be the new price of the bonds? New price of the bonds $ 1407.3 c. With a price of $858 what is the yield to maturity if the bond has 10 years to maturity? Yield to maturity o B Block1... D i earch pdf ... Block

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts