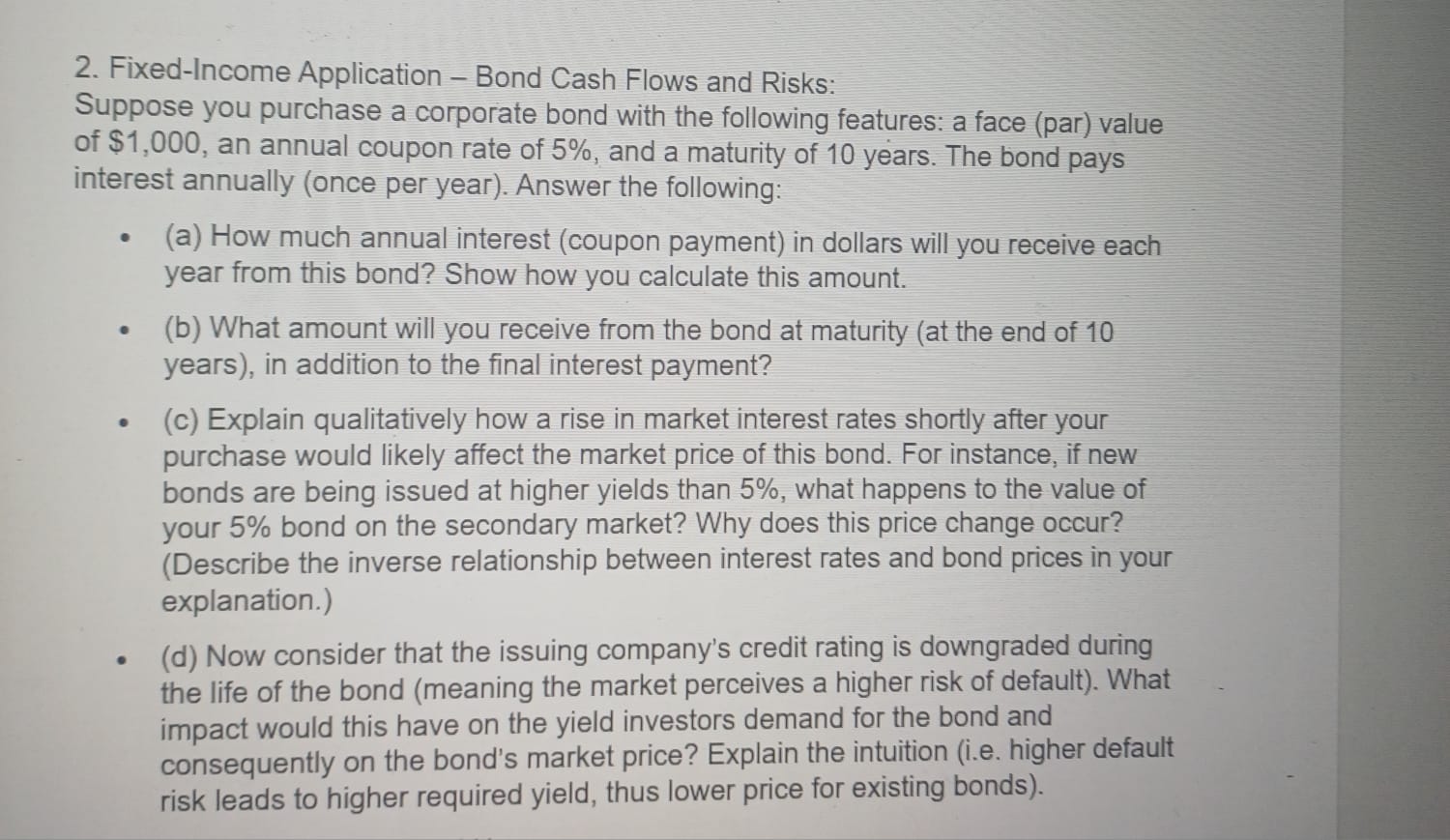

Question: 2 . Fixed - Income Application - Bond Cash Flows and Risks: Suppose you purchase a corporate bond with the following features: a face (

FixedIncome Application Bond Cash Flows and Risks: Suppose you purchase a corporate bond with the following features: a face par value of $ an annual coupon rate of and a maturity of years. The bond pays interest annually once per year Answer the following: a How much annual interest coupon payment in dollars will you receive each year from this bond? Show how you calculate this amount. b What amount will you receive from the bond at maturity at the end of years in addition to the final interest payment? c Explain qualitatively how a rise in market interest rates shortly after your purchase would likely affect the market price of this bond. For instance, if new bonds are being issued at higher yields than what happens to the value of your bond on the secondary market? Why does this price change occur? Describe the inverse relationship between interest rates and bond prices in your explanation.d Now consider that the issuing company's credit rating is downgraded during the life of the bond meaning the market perceives a higher risk of default What impact would this have on the yield investors demand for the bond and consequently on the bond's market price? Explain the intuition ie higher default risk leads to higher required yield, thus lower price for existing bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock