Question: 2. Fortes Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products

2.

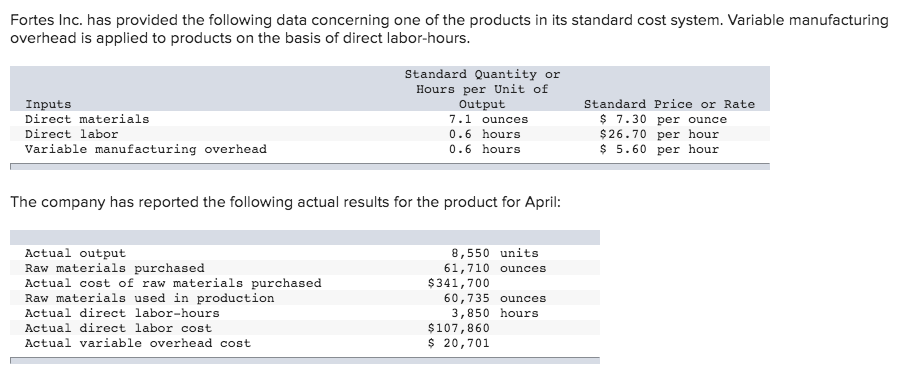

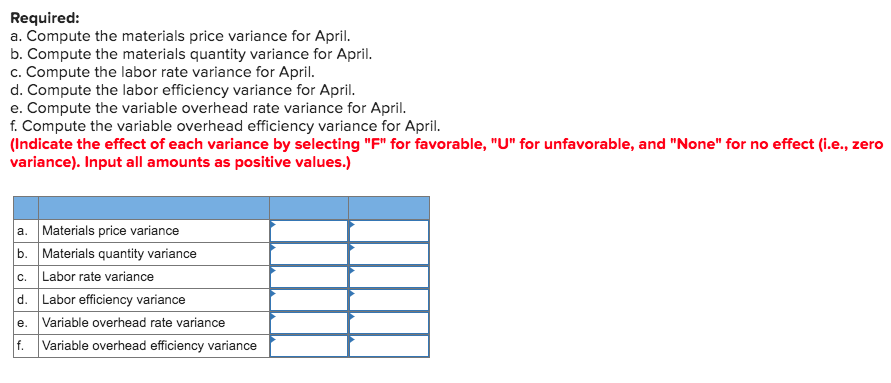

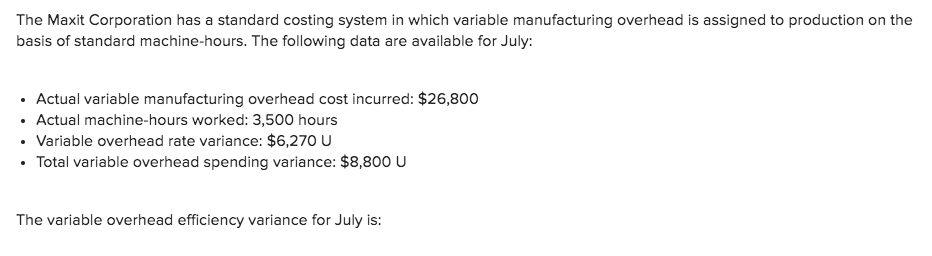

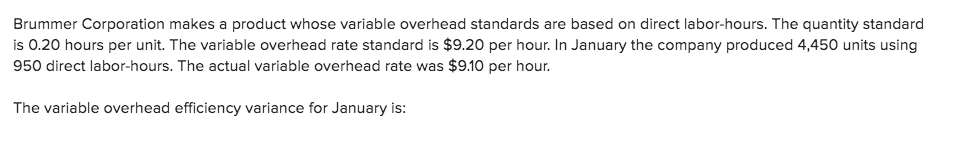

Fortes Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. Inputs Direct materials Direct labor Variable manufacturing overhead Standard Quantity or Hours per Unit of Output 7.1 ounces 0.6 hours 0.6 hours Standard Price or Rate $ 7.30 per ounce $26.70 per hour $ 5.60 per hour The company has reported the following actual results for the product for April: Actual output Raw materials purchased Actual cost of raw materials purchased Raw materials used in production Actual direct labor-hours Actual direct labor cost Actual variable overhead cost 8,550 units 61,710 ounces $341,700 60,735 ounces 3,850 hours $107,860 $ 20,701 Required: a. Compute the materials price variance for April. b. Compute the materials quantity variance for April. c. Compute the labor rate variance for April. d. Compute the labor efficiency variance for April. e. Compute the variable overhead rate variance for April. f. Compute the variable overhead efficiency variance for April. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) a. Materials price variance b. Materials quantity variance c. Labor rate variance d. Labor efficiency variance e. Variable overhead rate variance f. Variable overhead efficiency variance The Maxit Corporation has a standard costing system in which variable manufacturing overhead is assigned to production on the basis of standard machine-hours. The following data are available for July: Actual variable manufacturing overhead cost incurred: $26,800 Actual machine-hours worked: 3,500 hours Variable overhead rate variance: $6,270 U Total variable overhead spending variance: $8,800 U The variable overhead efficiency variance for July is: Brummer Corporation makes a product whose variable overhead standards are based on direct labor-hours. The quantity standard is 0.20 hours per unit. The variable overhead rate standard is $9.20 per hour. In January the company produced 4,450 units using 950 direct labor-hours. The actual variable overhead rate was $9.10 per hour. The variable overhead efficiency variance for January is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts