Question: 2. (From the sample exam) A bond with a face value of 100 has just been ale issued. The bond pays half-yearly coupons of 5%

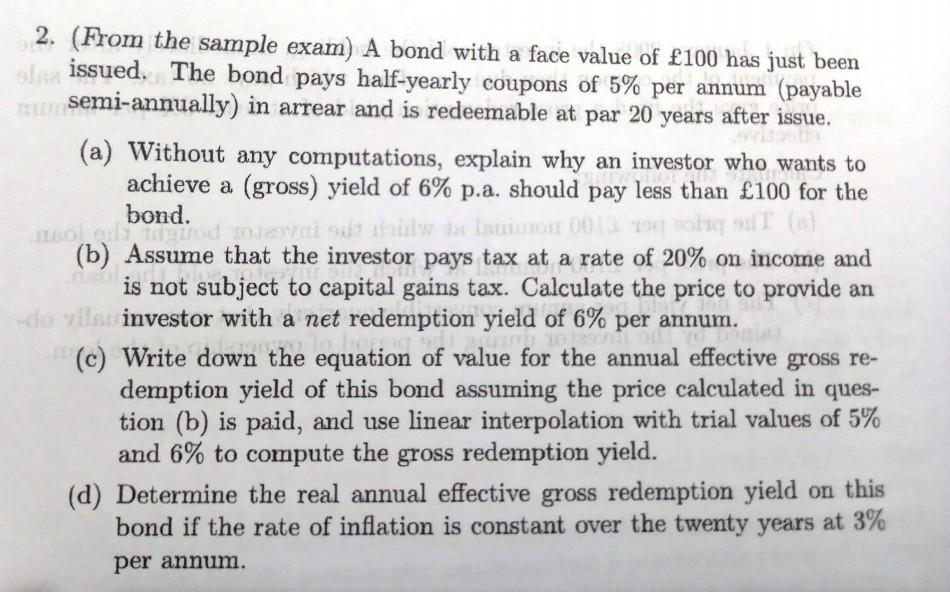

2. (From the sample exam) A bond with a face value of 100 has just been ale issued. The bond pays half-yearly coupons of 5% per annum (payable semi-annually) in arrear and is redeemable at par 20 years after issue. (a) Without any computations, explain why an investor who wants to achieve a (gross) yield of 6% p.a. should pay less than 100 for the bond. OLA (b) Assume that the investor pays tax at a rate of 20% on income and is not subject to capital gains tax. Calculate the price to provide an de vils investor with a net redemption yield of 6% per annum. (c) Write down the equation of value for the annual effective gross re- demption yield of this bond assuming the price calculated in ques- tion (b) is paid, and use linear interpolation with trial values of 5% and 6% to compute the gross redemption yield. (d) Determine the real annual effective gross redemption yield on this bond if the rate of inflation is constant over the twenty years at 3% per annum. 2. (From the sample exam) A bond with a face value of 100 has just been ale issued. The bond pays half-yearly coupons of 5% per annum (payable semi-annually) in arrear and is redeemable at par 20 years after issue. (a) Without any computations, explain why an investor who wants to achieve a (gross) yield of 6% p.a. should pay less than 100 for the bond. OLA (b) Assume that the investor pays tax at a rate of 20% on income and is not subject to capital gains tax. Calculate the price to provide an de vils investor with a net redemption yield of 6% per annum. (c) Write down the equation of value for the annual effective gross re- demption yield of this bond assuming the price calculated in ques- tion (b) is paid, and use linear interpolation with trial values of 5% and 6% to compute the gross redemption yield. (d) Determine the real annual effective gross redemption yield on this bond if the rate of inflation is constant over the twenty years at 3% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts