Question: 2. Future value functions How Excel can help you find the future value of your investments? One of the most commonly applied concepts in finance

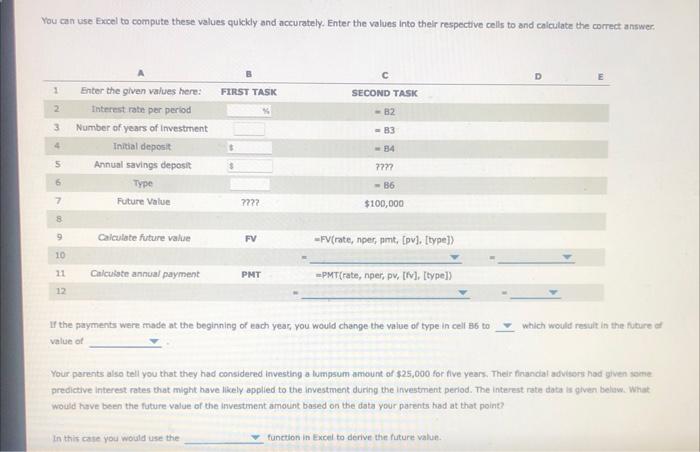

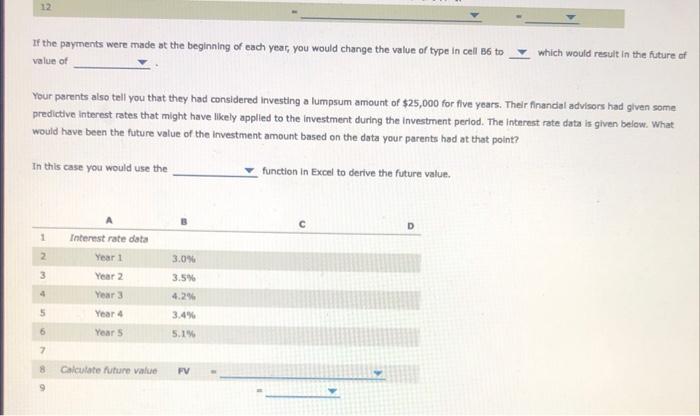

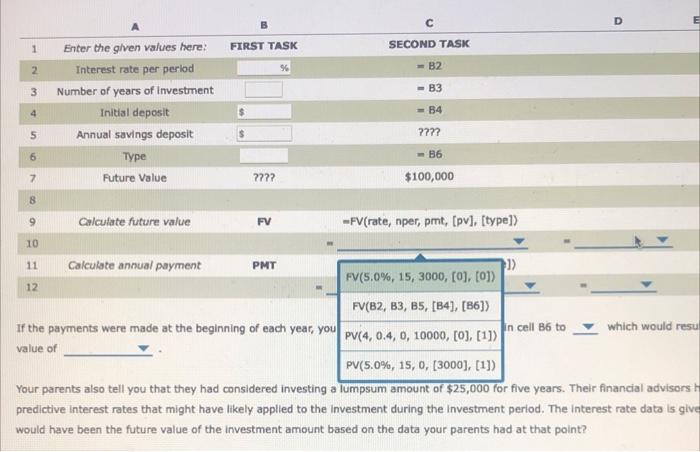

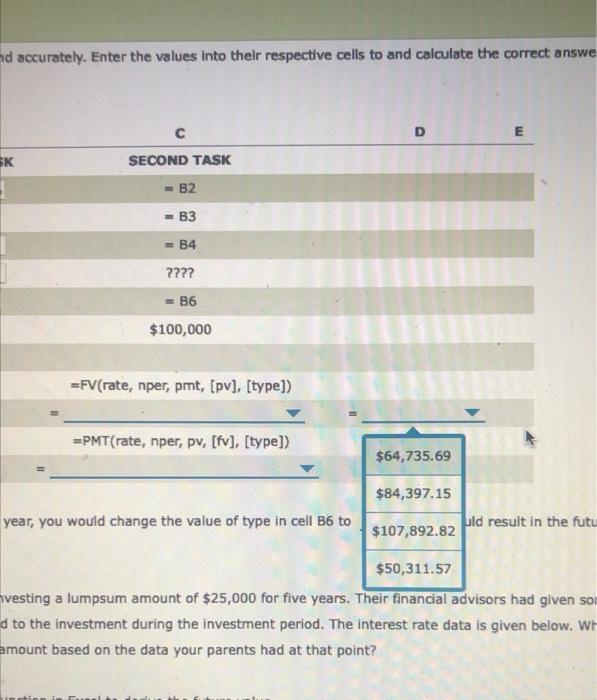

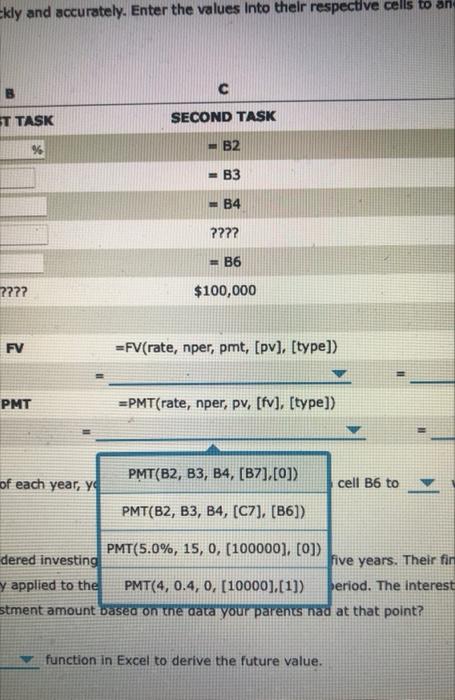

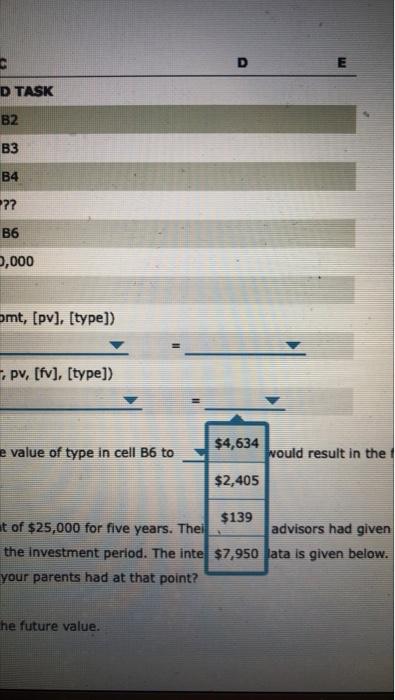

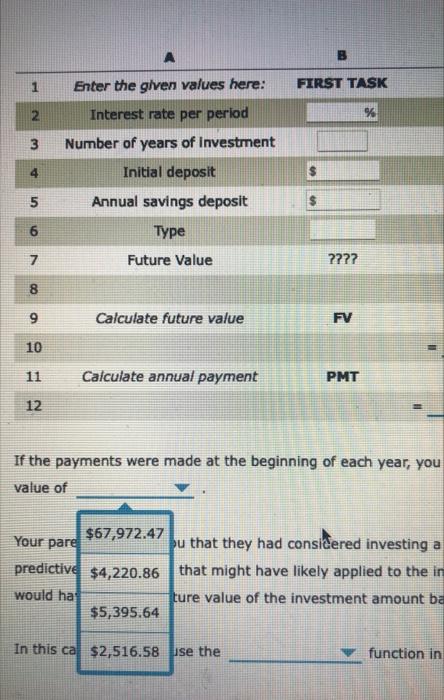

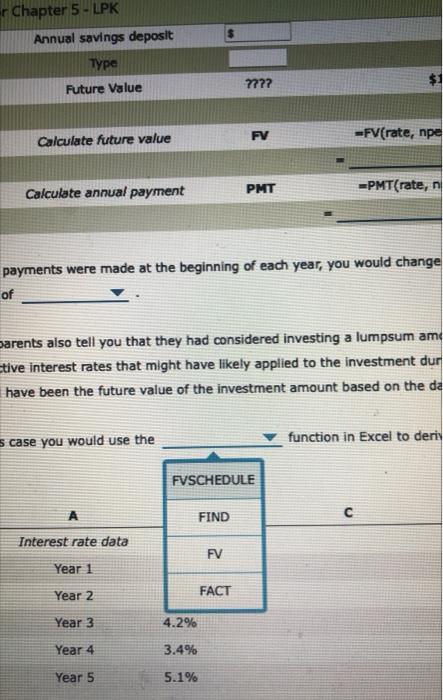

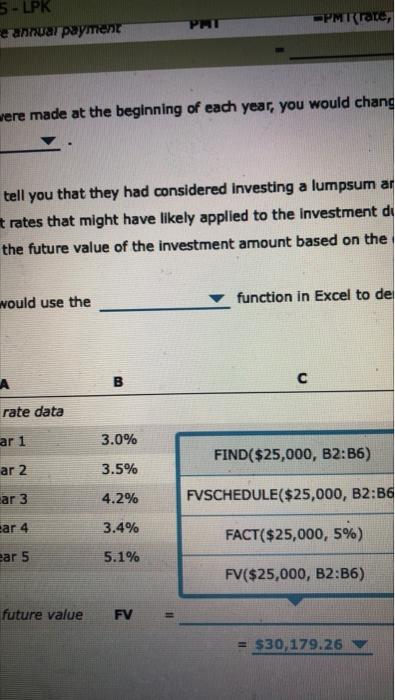

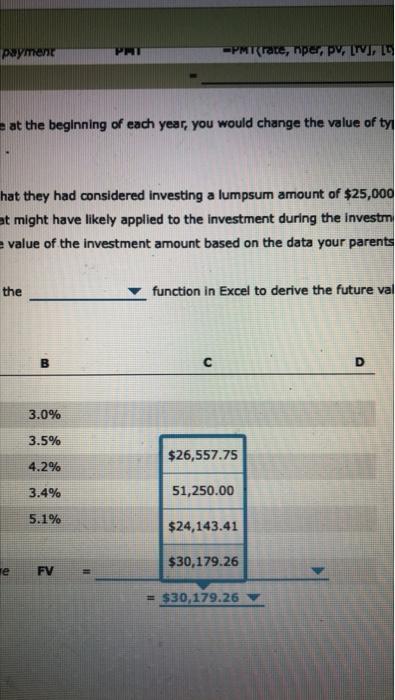

2. Future value functions How Excel can help you find the future value of your investments? One of the most commonly applied concepts in finance is the determination of the value of an investment in future. Future value calculations can help us understand the financial Implications of our decisions-such as the value of my retirement Investments in 40 years if it earns a certain rate of return. Or, how much will I have when my friend repays the loan he made from me and promised to pay x% Interest? Excel can be a handy tool to derive the future value of investments, loans, etc. Consider this example: You have just started college and you are having a discussion with your parents about how your college will be funded. Your parents explain that they have been investing in a college savings plan for the past 15 years that has earned them an average of 5.0% per year. They opened the account 15 years ago and since then have been investing 3000 every year at the end of the year. They ask you to do two things based on the information they provided: FIRST TASK: Calculate the amount of money that the college savings account should have accumulated by the end of 15 years. SECOND TASK: Calculate the annual savings that they should have made if they wanted to save at least $100,000 for your college education. You can use Excel to compute these values quickly and accurately. Enter the values into their respective cells to and calculate the correct answer You can use Excel to compute these values quickly and accurately. Enter the values into their respective cells to and calculate the correct answer. C 1 FIRST TASK SECOND TASK Enter the given values here: Interest rate per period %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts