Question: 2 Futures vs. Forward Contracts (15 points) Let's take another look at 50FR futures, and the impact that settlement (the early payments through marking to

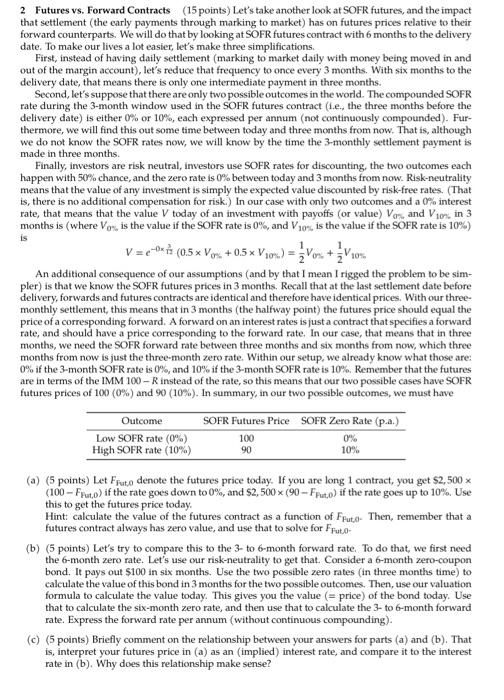

2 Futures vs. Forward Contracts (15 points) Let's take another look at 50FR futures, and the impact that settlement (the early payments through marking to market) has on futures prices relative to their forward counterparts. We will do that by looking at SOFR futures contract with 6 months to the delivery date. To make our lives a lot easier, let's make three simplifications. First, instead of having daily settlement (marking to market daily with money being moved in and out of the margin account), let's reduce that frequency to once every 3 months. With six months to the delivery date, that means there is only one intermediate payment in three months. Second, let's suppose that there are only two possible outcomes in the world. The compounded SOFR rate during the 3-month window used in the SOFR futures contract (i.e., the three months before the delivery date) is either 0% or 10%, each expressed per annum (not continuously compounded). Furthermore, we will find this out some time between today and three months from now. That is, although we do not know the SOFR rates now, we will know by the time the 3-monthly settlement payment is made in three months. Finally, investors are risk neutral, investors use SOFR rates for discounting, the two outcomes each happen with 50% chance, and the zero rate is 0% between today and 3 months from now. Risk-neutrality means that the value of any investment is simply the expected value discounted by risk-free rates. (That is, there is no additional compensation for risk.) In our case with only two outcomes and a 0% interest rate, that means that the value V today of an investment with payoffs (or value) V0% and V10n in 3 months is (where V0% is the value if the SOFR rate is 0%, and V10% is the value if the SOFR rate is 10\%) is V=e0123(0.5V0.+0.5V10%)=21V0n+21V10% An additional consequence of our assumptions (and by that I mean I rigged the problem to be simpler) is that we know the SOFR futures prices in 3 months. Recall that at the last settlement date before delivery, forwards and futures contracts are identical and therefore have identical prices. With our threemonthly settlement, this means that in 3 months (the halfway point) the futures price should equal the price of a corresponding forward. A forward on an interest rates is just a contract that specifies a forward rate, and should have a price corresponding to the forward rate. In our case, that means that in three months, we need the SOFR forward rate between three months and six months from now, which three months from now is just the three-month zero rate. Within our setup, we already know what those are: 0% if the 3-month SOFR rate is 0%, and 10% if the 3-month SOFR rate is 10%. Remember that the futures are in terms of the IMM 100R instead of the rate, so this means that our two possible cases have SOFR futures prices of 100(0%) and 90(10%). In summary, in our two possible outcomes, we must have (a) (5 points) Let FFut, denote the futures price today. If you are long 1 contract, you get $2,500 (100FFut,0) if the rate goes down to 0%, and $2,500(90FFut,0) if the rate goes up to 10%. Use this to get the futures price today. Hint: calculate the value of the futures contract as a function of FFut,0.. Then, remember that a futures contract always has zero value, and use that to solve for FFut,0- (b) (5 points) Let's try to compare this to the 3-to 6-month forward rate. To do that, we first need the 6-month zero rate. Let's use our risk-neutrality to get that. Consider a 6-month zero-coupon bond. It pays out $100 in six months. Use the two possible zero rates (in three months time) to calculate the value of this bond in 3 months for the two possible outcomes. Then, use our valuation formula to calculate the value today. This gives you the value (= price) of the bond today. Use that to calculate the six-month zero rate, and then use that to calculate the 3-to 6-month forward rate. Express the forward rate per annum (without continuous compounding). (c) (5 points) Briefly comment on the relationship between your answers for parts (a) and (b). That is, interpret your futures price in (a) as an (implied) interest rate, and compare it to the interest rate in (b). Why does this relationship make sense? 2 Futures vs. Forward Contracts (15 points) Let's take another look at 50FR futures, and the impact that settlement (the early payments through marking to market) has on futures prices relative to their forward counterparts. We will do that by looking at SOFR futures contract with 6 months to the delivery date. To make our lives a lot easier, let's make three simplifications. First, instead of having daily settlement (marking to market daily with money being moved in and out of the margin account), let's reduce that frequency to once every 3 months. With six months to the delivery date, that means there is only one intermediate payment in three months. Second, let's suppose that there are only two possible outcomes in the world. The compounded SOFR rate during the 3-month window used in the SOFR futures contract (i.e., the three months before the delivery date) is either 0% or 10%, each expressed per annum (not continuously compounded). Furthermore, we will find this out some time between today and three months from now. That is, although we do not know the SOFR rates now, we will know by the time the 3-monthly settlement payment is made in three months. Finally, investors are risk neutral, investors use SOFR rates for discounting, the two outcomes each happen with 50% chance, and the zero rate is 0% between today and 3 months from now. Risk-neutrality means that the value of any investment is simply the expected value discounted by risk-free rates. (That is, there is no additional compensation for risk.) In our case with only two outcomes and a 0% interest rate, that means that the value V today of an investment with payoffs (or value) V0% and V10n in 3 months is (where V0% is the value if the SOFR rate is 0%, and V10% is the value if the SOFR rate is 10\%) is V=e0123(0.5V0.+0.5V10%)=21V0n+21V10% An additional consequence of our assumptions (and by that I mean I rigged the problem to be simpler) is that we know the SOFR futures prices in 3 months. Recall that at the last settlement date before delivery, forwards and futures contracts are identical and therefore have identical prices. With our threemonthly settlement, this means that in 3 months (the halfway point) the futures price should equal the price of a corresponding forward. A forward on an interest rates is just a contract that specifies a forward rate, and should have a price corresponding to the forward rate. In our case, that means that in three months, we need the SOFR forward rate between three months and six months from now, which three months from now is just the three-month zero rate. Within our setup, we already know what those are: 0% if the 3-month SOFR rate is 0%, and 10% if the 3-month SOFR rate is 10%. Remember that the futures are in terms of the IMM 100R instead of the rate, so this means that our two possible cases have SOFR futures prices of 100(0%) and 90(10%). In summary, in our two possible outcomes, we must have (a) (5 points) Let FFut, denote the futures price today. If you are long 1 contract, you get $2,500 (100FFut,0) if the rate goes down to 0%, and $2,500(90FFut,0) if the rate goes up to 10%. Use this to get the futures price today. Hint: calculate the value of the futures contract as a function of FFut,0.. Then, remember that a futures contract always has zero value, and use that to solve for FFut,0- (b) (5 points) Let's try to compare this to the 3-to 6-month forward rate. To do that, we first need the 6-month zero rate. Let's use our risk-neutrality to get that. Consider a 6-month zero-coupon bond. It pays out $100 in six months. Use the two possible zero rates (in three months time) to calculate the value of this bond in 3 months for the two possible outcomes. Then, use our valuation formula to calculate the value today. This gives you the value (= price) of the bond today. Use that to calculate the six-month zero rate, and then use that to calculate the 3-to 6-month forward rate. Express the forward rate per annum (without continuous compounding). (c) (5 points) Briefly comment on the relationship between your answers for parts (a) and (b). That is, interpret your futures price in (a) as an (implied) interest rate, and compare it to the interest rate in (b). Why does this relationship make sense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts