Question: 2. Given a coupon bond B = {F = $100,C=S5, T = 3 yrs). Please do provide formula and/or steps for credits. (a) What is

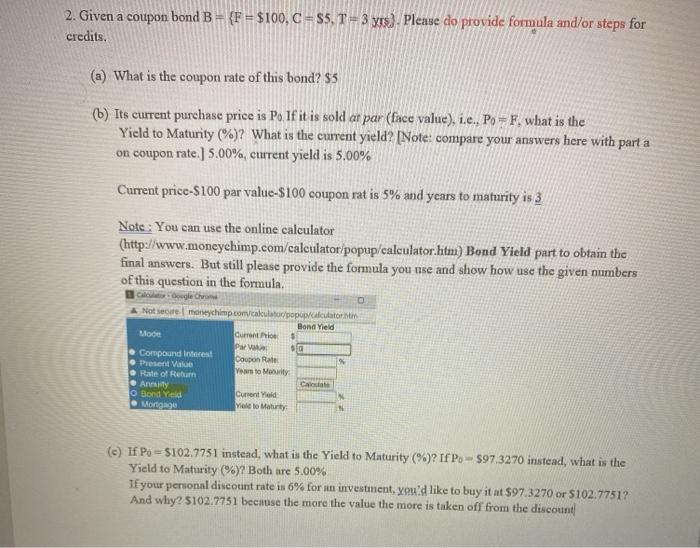

2. Given a coupon bond B = {F = $100,C=S5, T = 3 yrs). Please do provide formula and/or steps for credits. (a) What is the coupon rate of this bond? $5 (6) Its current purchase price is P. If it is sold at par (face value), i.e., Po - F, what is the Yield to Maturity (%)? What is the current yield? (Note: compare your answers here with part a on coupon rate.) 5.00%, current yield is 5.00% Current price-S100 par value-$100 coupon rat is 5% and years to maturity is 3 Note: You can use the online calculator (http://www.moneychimp.com/calculator popup/calculator.htm) Bond Yield part to obtain the final answers. But still please provide the formula you use and show how use the given numbers of this question in the formula. Mode Not see more chimp.com/calculator/popup/calculator in Bond Yield Current Pro Par Compound interest Coopon Rate Present Value Rate of Return Yours to Maurity Anty Catate Bond Yeld Current Mortgage Viello Maturty (C) If Po=5102.7751 instead, what is the Yield to Maturity (%)? If Po-$97.3270 instead, what is the Yield to Maturity (%)? Both are 5.00% If your personal discount rate is 6% for an investment, you'd like to buy it at $97.3270 or 5102.7751? And why? 5102.7751 because the more the value the more is taken off from the discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts