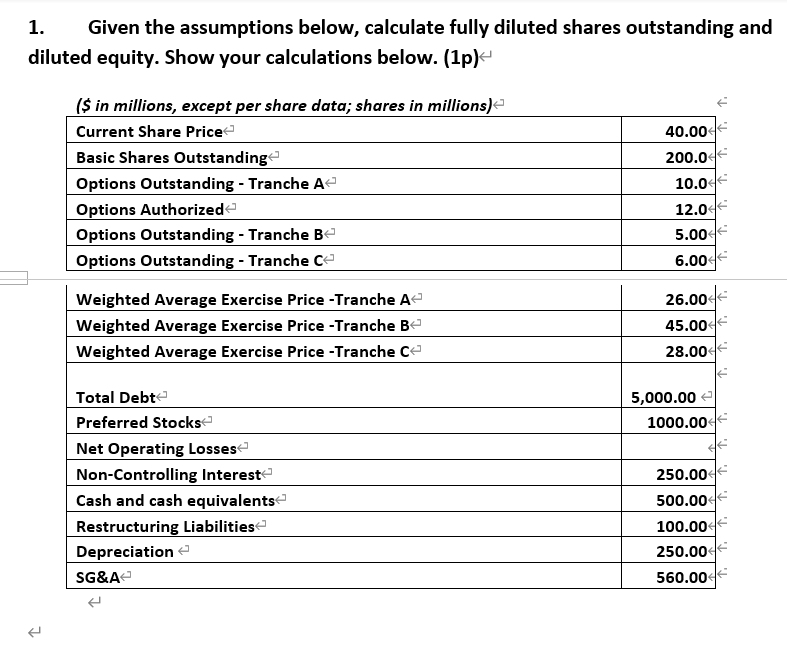

Question: 2. Given the assumptions above, calculate equity values and enterprise value. Show your calculations. 1. Given the assumptions below, calculate fully diluted shares outstanding and

2. Given the assumptions above, calculate equity values and enterprise value. Show your calculations.

1. Given the assumptions below, calculate fully diluted shares outstanding and diluted equity. Show your calculations below. (10) ($ in millions, except per share data; shares in millions) Current Share Price Basic Shares Outstanding Options Outstanding - Tranche A Options Authorized Options Outstanding - Tranche B Options Outstanding - Tranche C 40.00 200.04 10.04 12.04 5.00 6.00 Weighted Average Exercise Price -Tranche A Weighted Average Exercise Price - Tranche Be Weighted Average Exercise Price -Tranche ce 26.00 45.00 28.00 5,000.00 1000.00 Total Debt Preferred Stocks Net Operating Losses Non-Controlling Interest Cash and cash equivalents Restructuring Liabilities Depreciatione SG&A 250.00 500.00 100.00 250.00 560.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts