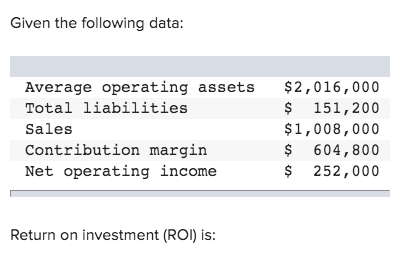

Question: 2. Given the following data: Average operating assets $2,016,000 $ 151,200 Total liabilities Sales $1,008,000 Contribution margin $604,800 Net operating income 252,000 Return on investment

2.

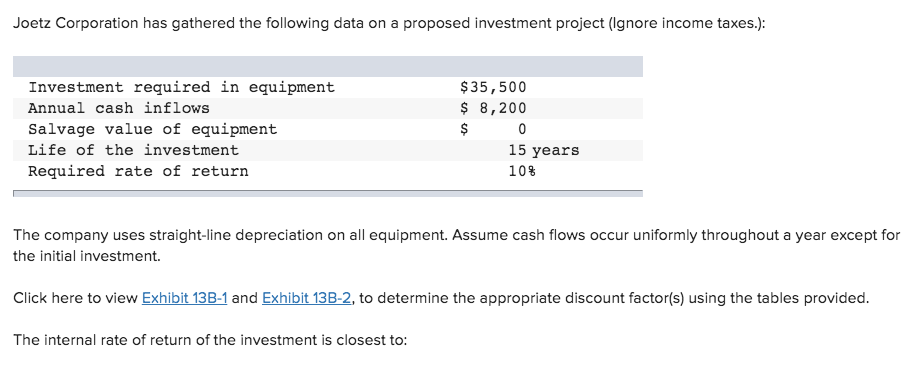

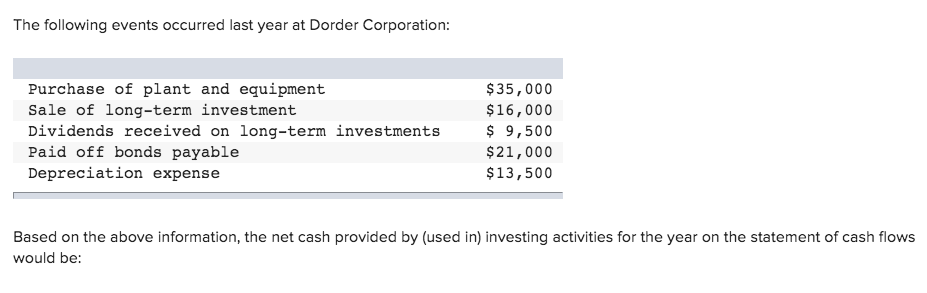

Given the following data: Average operating assets $2,016,000 $ 151,200 Total liabilities Sales $1,008,000 Contribution margin $604,800 Net operating income 252,000 Return on investment (ROI) is: Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment $35,500 $ 8,200 Annual cash inflows Salvage value of equipment $ 0 Life of the investment 15 years Required rate of return 103 The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. The internal rate of return of the investment is closest to: The following events occurred last year at Dorder Corporation: Purchase of plant and equipment Sale of long-term investment Dividends received on long-term investments Paid off bonds payable Depreciation expense $35,000 $16,000 9,500 $21,000 $13,500 Based on the above information, the net cash provided by (used in) investing activities for the year on the statement of cash flows would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts