Question: 2. Given the information below--and using the Excel worksheet provided--calculate the following figures: a. Percentage of Completion Method i. Gross Income, Years 1-3 ii. Net

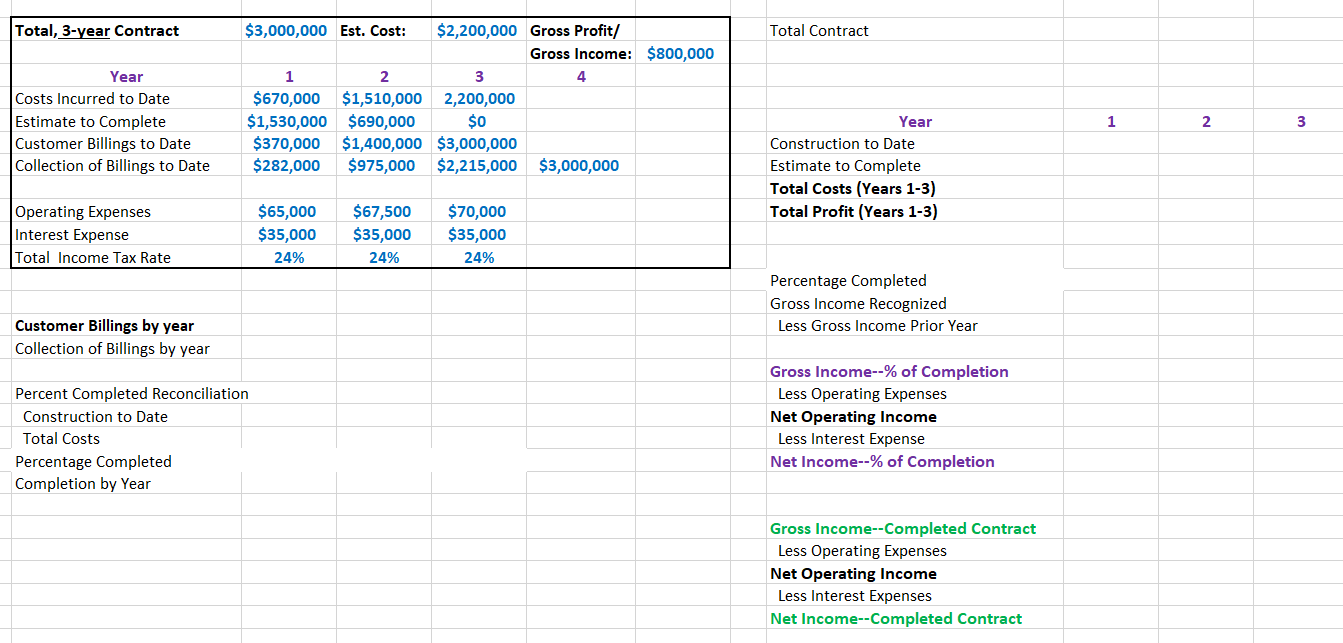

2. Given the information below--and using the Excel worksheet provided--calculate the following figures: a. Percentage of Completion Method i. Gross Income, Years 1-3 ii. Net Income, Years 1-3 b. Completed Contract Method i. Gross Income, Year 3 Gross Net Income, Year 3 Total, 3-year Contract Total Contract Year Costs Incurred to Date Estimate to Complete Customer Billings to Date Collection of Billings to Date $3,000,000 Est. Cost: $2,200,000 Gross Profit/ Gross Income: $800,000 3 $670,000 $1,510,000 2,200,000 $1,530,000 $690,000 $0 $370,000 $1,400,000 $3,000,000 $282,000 $975,000 $2,215,000 $3,000,000 Year Construction to Date Estimate to Complete Total Costs (Years 1-3) Total Profit (Years 1-3) Operating Expenses Interest Expense Total Income Tax Rate $65,000 $35,000 24% $67,500 $35,000 $70,000 $35,000 24% 24% Percentage Completed Gross Income Recognized Less Gross Income Prior Year Customer Billings by year Collection of Billings by year Percent Completed Reconciliation Construction to Date Total Costs Percentage Completed Completion by Year Gross Income--% of Completion Less Operating Expenses Net Operating Income Less Interest Expense Net Income--% of Completion Gross Income--Completed Contract Less Operating Expenses Net Operating Income Less Interest Expenses Net Income--Completed Contract 2. Given the information below--and using the Excel worksheet provided--calculate the following figures: a. Percentage of Completion Method i. Gross Income, Years 1-3 ii. Net Income, Years 1-3 b. Completed Contract Method i. Gross Income, Year 3 Gross Net Income, Year 3 Total, 3-year Contract Total Contract Year Costs Incurred to Date Estimate to Complete Customer Billings to Date Collection of Billings to Date $3,000,000 Est. Cost: $2,200,000 Gross Profit/ Gross Income: $800,000 3 $670,000 $1,510,000 2,200,000 $1,530,000 $690,000 $0 $370,000 $1,400,000 $3,000,000 $282,000 $975,000 $2,215,000 $3,000,000 Year Construction to Date Estimate to Complete Total Costs (Years 1-3) Total Profit (Years 1-3) Operating Expenses Interest Expense Total Income Tax Rate $65,000 $35,000 24% $67,500 $35,000 $70,000 $35,000 24% 24% Percentage Completed Gross Income Recognized Less Gross Income Prior Year Customer Billings by year Collection of Billings by year Percent Completed Reconciliation Construction to Date Total Costs Percentage Completed Completion by Year Gross Income--% of Completion Less Operating Expenses Net Operating Income Less Interest Expense Net Income--% of Completion Gross Income--Completed Contract Less Operating Expenses Net Operating Income Less Interest Expenses Net Income--Completed Contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts