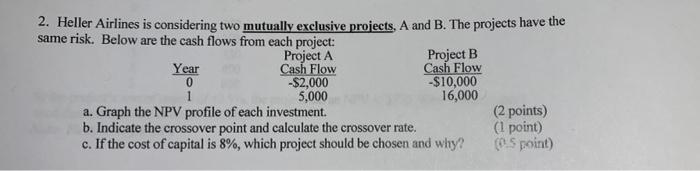

Question: 2. Heller Airlines is considering two mutually exclusive projects, A and B. The projects have the same risk. Below are the cash flows from each

2. Heller Airlines is considering two mutually exclusive projects, A and B. The projects have the same risk. Below are the cash flows from each project: Project A Project B Year Cash Flow Cash Flow 0 -$2,000 -$10,000 1 5,000 16,000 a. Graph the NPV profile of each investment. (2 points) b. Indicate the crossover point and calculate the crossover rate. (1 point) c. If the cost of capital is 8%, which project should be chosen and why? cos point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts