Question: 2 https:/learn-us-east-1-prod-fleet01-xythos.s3.us-east-1.amazonaws.com/5bBel (4) Happy Times currently has an all-cash policy. It is considering making a change in the credit policy by going to terms of

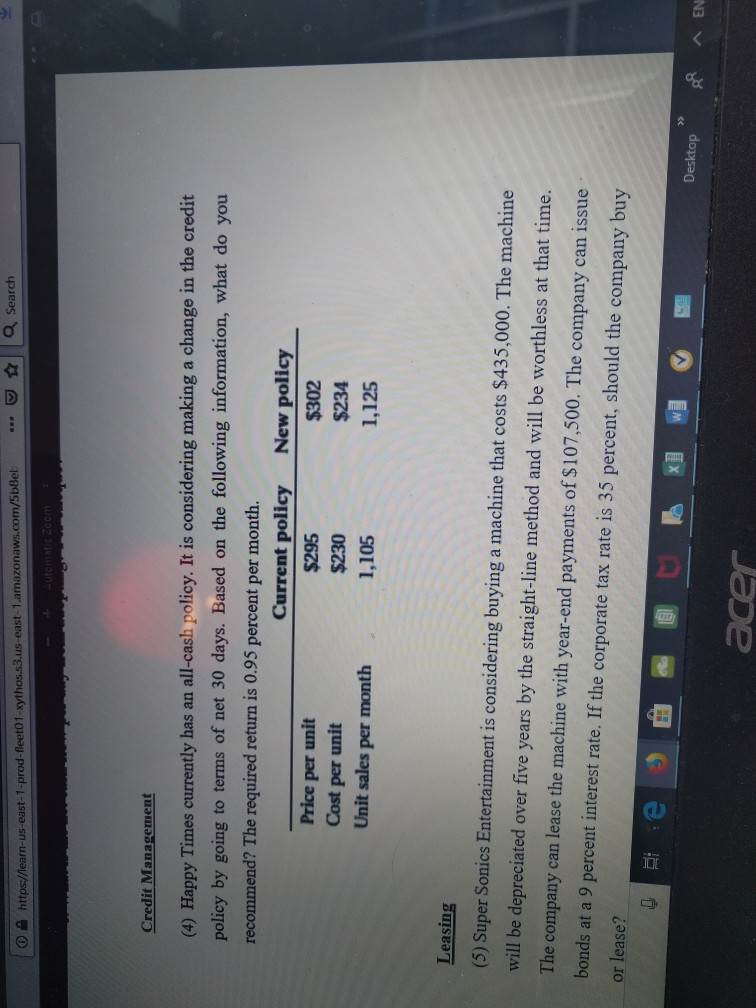

2 https:/learn-us-east-1-prod-fleet01-xythos.s3.us-east-1.amazonaws.com/5bBel (4) Happy Times currently has an all-cash policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you recommend? The required return is 0.95 percent per month. Price per unit Cost per unit Unit sales per month Current policy $295 $230 1,105 New policy $302 $234 1,125 Leasing (5) Super Sonics Entertainment is considering buying a machine that costs $435,000. The machine will be depreciated over five years by the straight-line method and will be worthless at that time. The company can lease the machine with year-end payments of $107,500. The company can issue bonds at a 9 percent interest rate. If the corporate tax rate is 35 percent, should the company buy or lease? D2 Desktop RA EN acer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts