Question: 2. i need help with this problem for my corporate finace class. It would be much appriected if you can show me how you got

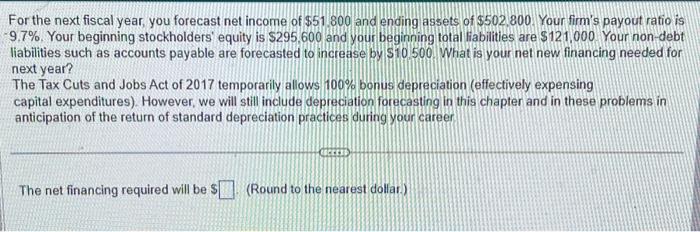

For the next fiscal year, you forecast net income of $51.800 and ending assets of $502.800. Your firm's payout ratio is 9.7\%. Your beginning stockholders' equity is $295,600 and your beginning total liabilities are \$121,000 Your non-debt liabilities such as accounts payable are forecasted to increase by $10.500. What is your net new financing needed for next year? The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career The net financing required will be $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts