Question: 2 (i) What is the difference between entering into a long forward contract when the forward price is $50 and taking a long position in

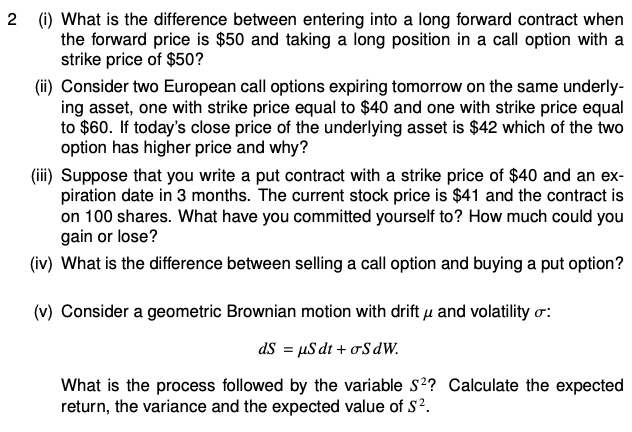

2 (i) What is the difference between entering into a long forward contract when the forward price is $50 and taking a long position in a call option with a strike price of $50? (ii) Consider two European call options expiring tomorrow on the same underly- ing asset, one with strike price equal to $40 and one with strike price equal to $60. If today's close price of the underlying asset is $42 which of the two option has higher price and why? (iii) Suppose that you write a put contract with a strike price of $40 and an ex- piration date in 3 months. The current stock price is $41 and the contract is on 100 shares. What have you committed yourself to? How much could you gain or lose? (iv) What is the difference between selling a call option and buying a put option? (v) Consider a geometric Brownian motion with drift u and volatility o: dS = uS dt+oSdW. What is the process followed by the variable s?? Calculate the expected return, the variance and the expected value of S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts