Question: 2 ) In net present value analysis, the minimum desired rate of return for an investment project depends on the of a proposed project. A

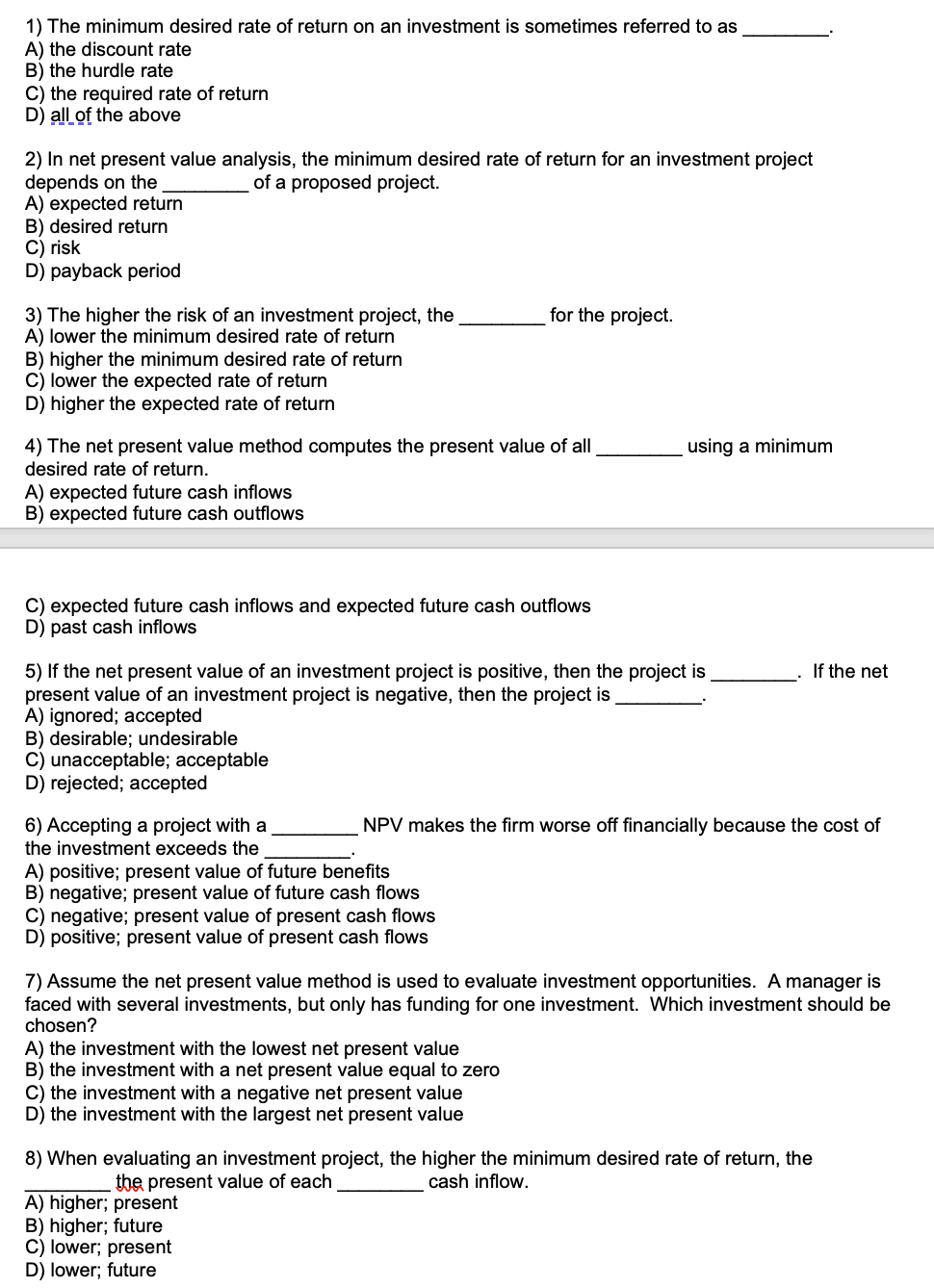

In net present value analysis, the minimum desired rate of return for an investment project depends on the of a proposed project. A expected return B desired return C risk D payback period The higher the risk of an investment project, the for the project. A lower the minimum desired rate of return B higher the minimum desired rate of return C lower the expected rate of return D higher the expected rate of return The net present value method computes the present value of all using a minimum desired rate of return. A expected future cash inflows B expected future cash outflows C expected future cash inflows and expected future cash outflows D past cash inflows If the net present value of an investment project is positive, then the project is present value of an investment project is negative, then the project is A ignored; accepted B desirable; undesirable C unacceptable; acceptable D rejected; accepted Accepting a project with a NPV makes the firm worse off financially because the cost of the investment exceeds the A positive; present value of future benefits B negative; present value of future cash flows C negative; present value of present cash flows D positive; present value of present cash flows Assume the net present value method is used to evaluate investment opportunities. A manager is faced with several investments, but only has funding for one investment. Which investment should be chosen? A the investment with the lowest net present value B the investment with a net present value equal to zero C the investment with a negative net present value D the investment with the largest net present value When evaluating an investment project, the higher the minimum desired rate of return, the the present value of each cash inflow. A higher; present B higher; future C lower; present D lower; future

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock