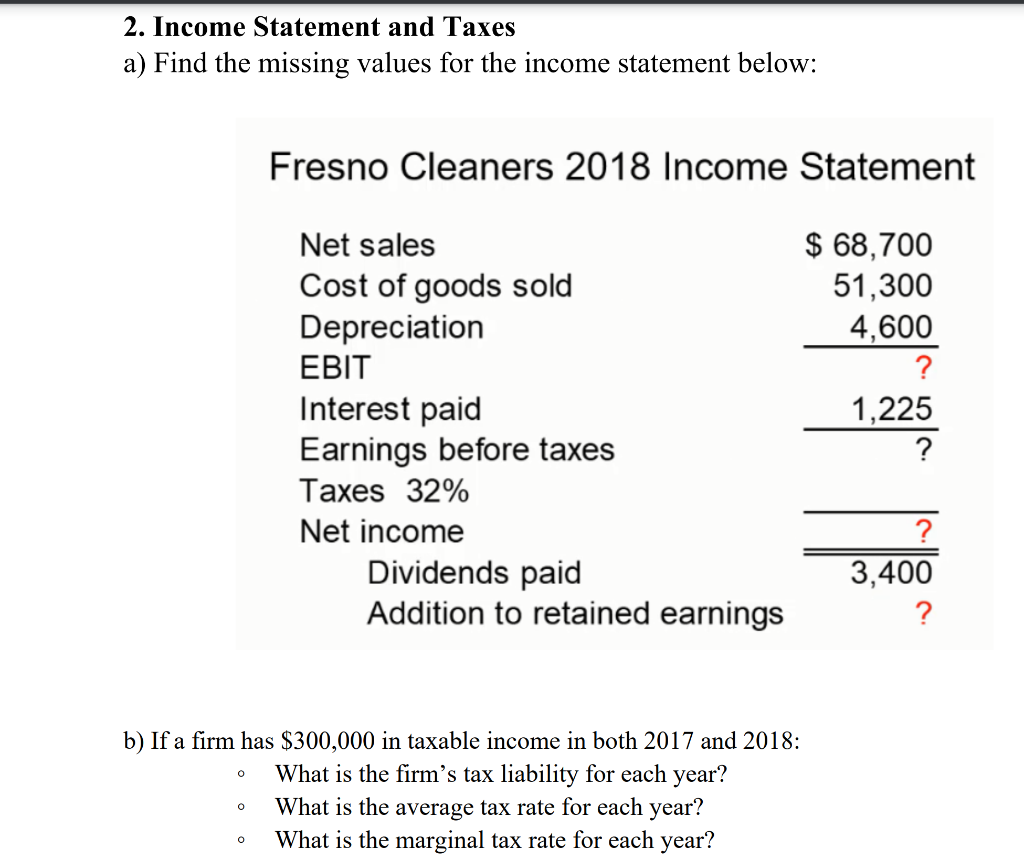

Question: 2. Income Statement and Taxes a) Find the missing values for the income statement below: Fresno Cleaners 2018 Income Statement Net sales Cost of goods

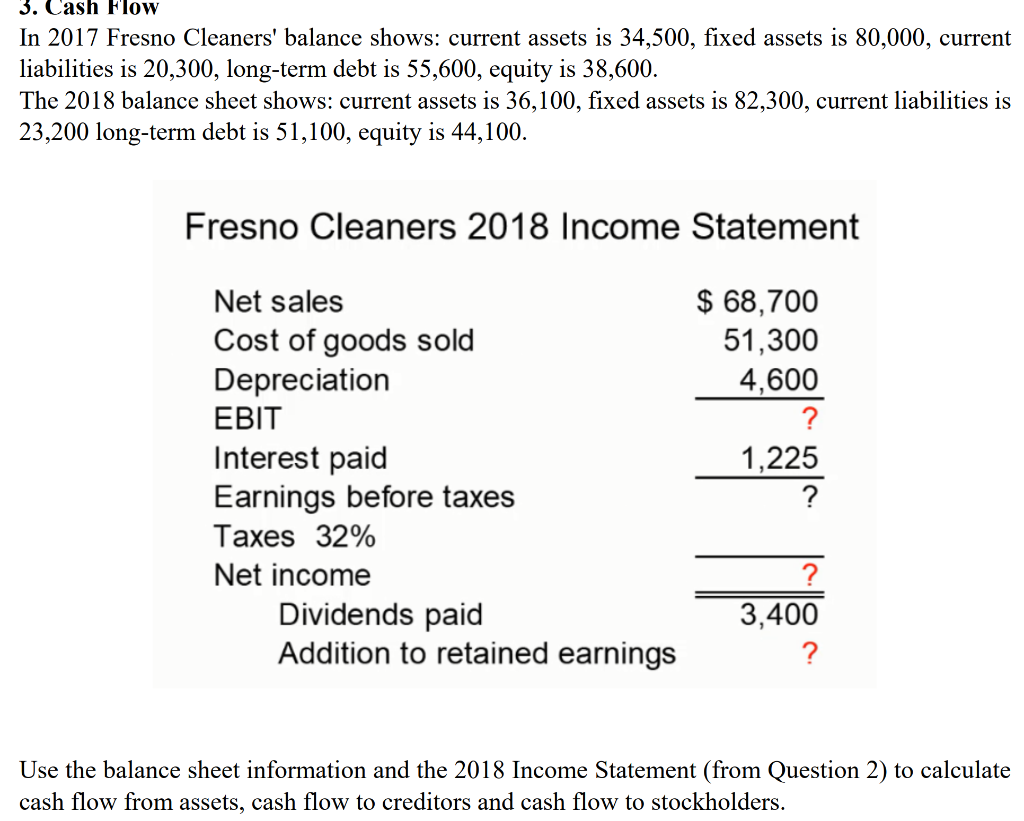

2. Income Statement and Taxes a) Find the missing values for the income statement below: Fresno Cleaners 2018 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest paid Earnings before taxes Taxes 32% Net income Dividends paid Addition to retained earnings $ 68,700 51,300 4,600 ? 1,225 ? ? 3,400 ? O b) If a firm has $300,000 in taxable income in both 2017 and 2018: What is the firm's tax liability for each year? What is the average tax rate for each year? What is the marginal tax rate for each year? o 3. Cash Flow In 2017 Fresno Cleaners' balance shows: current assets is 34,500, fixed assets is 80,000, current liabilities is 20,300, long-term debt is 55,600, equity is 38,600. The 2018 balance sheet shows: current assets is 36,100, fixed assets is 82,300, current liabilities is 23,200 long-term debt is 51,100, equity is 44,100. Fresno Cleaners 2018 Income Statement $ 68,700 51,300 4,600 ? 1,225 Net sales Cost of goods sold Depreciation EBIT Interest paid Earnings before taxes Taxes 32% Net income Dividends paid Addition to retained earnings 3,400 ? Use the balance sheet information and the 2018 Income Statement (from Question 2) to calculate cash flow from assets, cash flow to creditors and cash flow to stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts