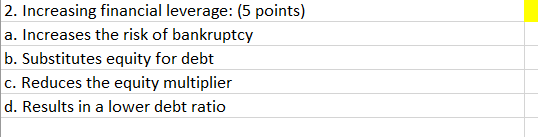

Question: 2. Increasing financial leverage: (5 points) a. Increases the risk of bankruptcy b. Substitutes equity for debt c. Reduces the equity multiplier d. Results in

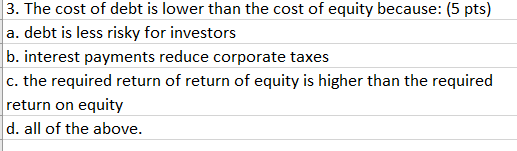

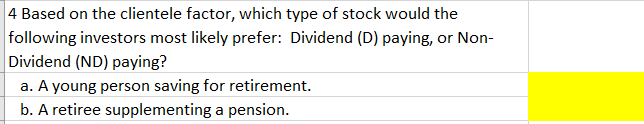

2. Increasing financial leverage: (5 points) a. Increases the risk of bankruptcy b. Substitutes equity for debt c. Reduces the equity multiplier d. Results in a lower debt ratio 3. The cost of debt is lower than the cost of equity because: (5 pts) a. debt is less risky for investors b. interest payments reduce corporate taxes c. the required return of return of equity is higher than the required return on equity d. all of the above. 4 Based on the clientele factor, which type of stock would the following investors most likely prefer: Dividend (D) paying, or Non- Dividend (ND) paying? a. A young person saving for retirement. b. A retiree supplementing a pension

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts