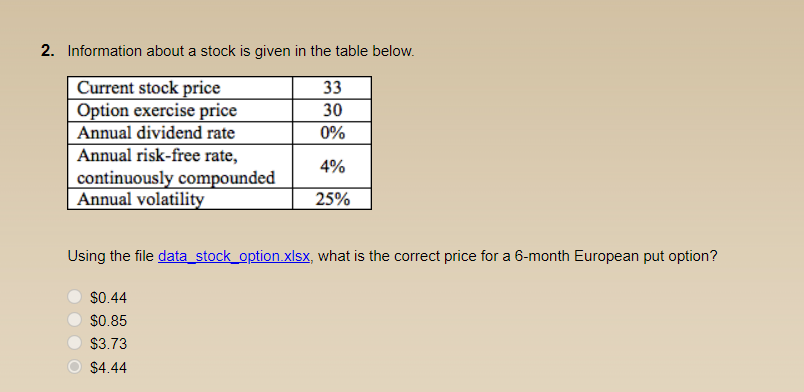

Question: 2. Information about a stock is given in the table below. Current stock price 33 Option exercise price 30 Annual dividend rate 0% Annual risk-free

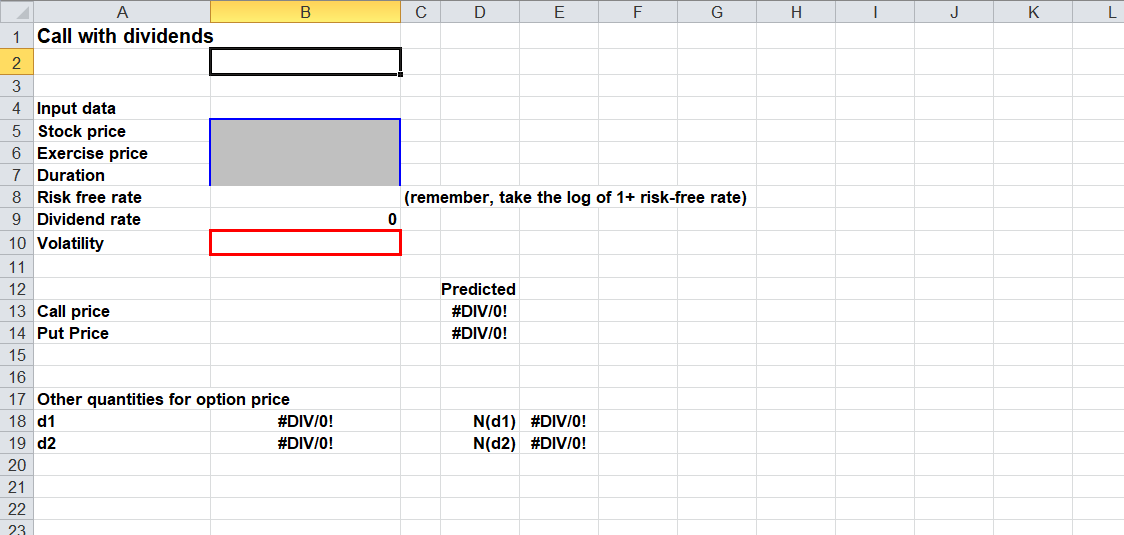

2. Information about a stock is given in the table below. Current stock price 33 Option exercise price 30 Annual dividend rate 0% Annual risk-free rate, 4% continuously compounded Annual volatility 25% Using the file data_stock_option.xlsx, what is the correct price for a 6-month European put option? $0.44 $0.85 $3.73 $4.44 B D E F G H . J K 1 Call with dividends (remember, take the log of 1+ risk-free rate) 0 4 Input data 5 Stock price 6 Exercise price 7 Duration 8 Risk free rate 9 Dividend rate 10 Volatility 11 12 13 Call price 14 Put Price 15 16 17 Other quantities for option price 18 d 1 #DIV/0! 19 d2 #DIV/0! 20 21 22 23 Predicted #DIV/0! #DIV/0! N(d1) #DIV/0! N(2) #DIV/0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts