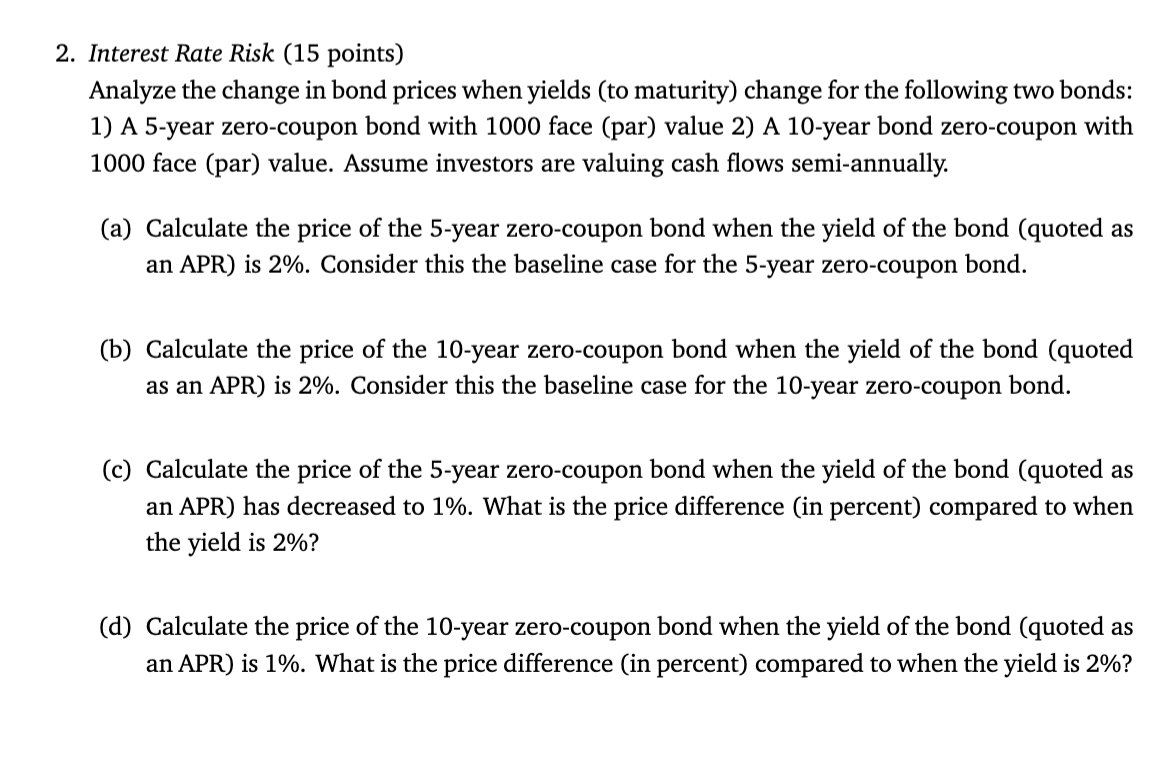

Question: 2 . Interest Rate Risk ( 1 5 points ) Analyze the change in bond prices when yields ( to maturity ) change for the

Interest Rate Risk points Analyze the change in bond prices when yields to maturity change for the following two bonds: A year zerocoupon bond with face par value A year bond zerocoupon with face par value. Assume investors are valuing cash flows semiannually. a Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR is Consider this the baseline case for the year zerocoupon bond. b Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR is Consider this the baseline case for the year zerocoupon bond. c Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR has decreased to What is the price difference in percent compared to when the yield is d Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR is What is the price difference in percent compared to when the yield is e Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR is What is the price difference in percent compared to when the yield is

f Calculate the price of the year zerocoupon bond when the yield of the bond quoted as an APR is What is the price difference in percent compared to when the yield is

g Describe the changes in bond prices in percentages you've calculated due to their maturity and changes in yields. For the same increase or decrease in yields, how do bond prices change depending on their maturity? With your answer, you're describing bond interest rate risk differences due to bond maturity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock