Question: #2 is incorrect. Please fix it. Davam computers should reject Peans ollei vien comparing relevant COSIS Detween ue Choices, reaches oner price is nigne udn

#2 is incorrect. Please fix it.

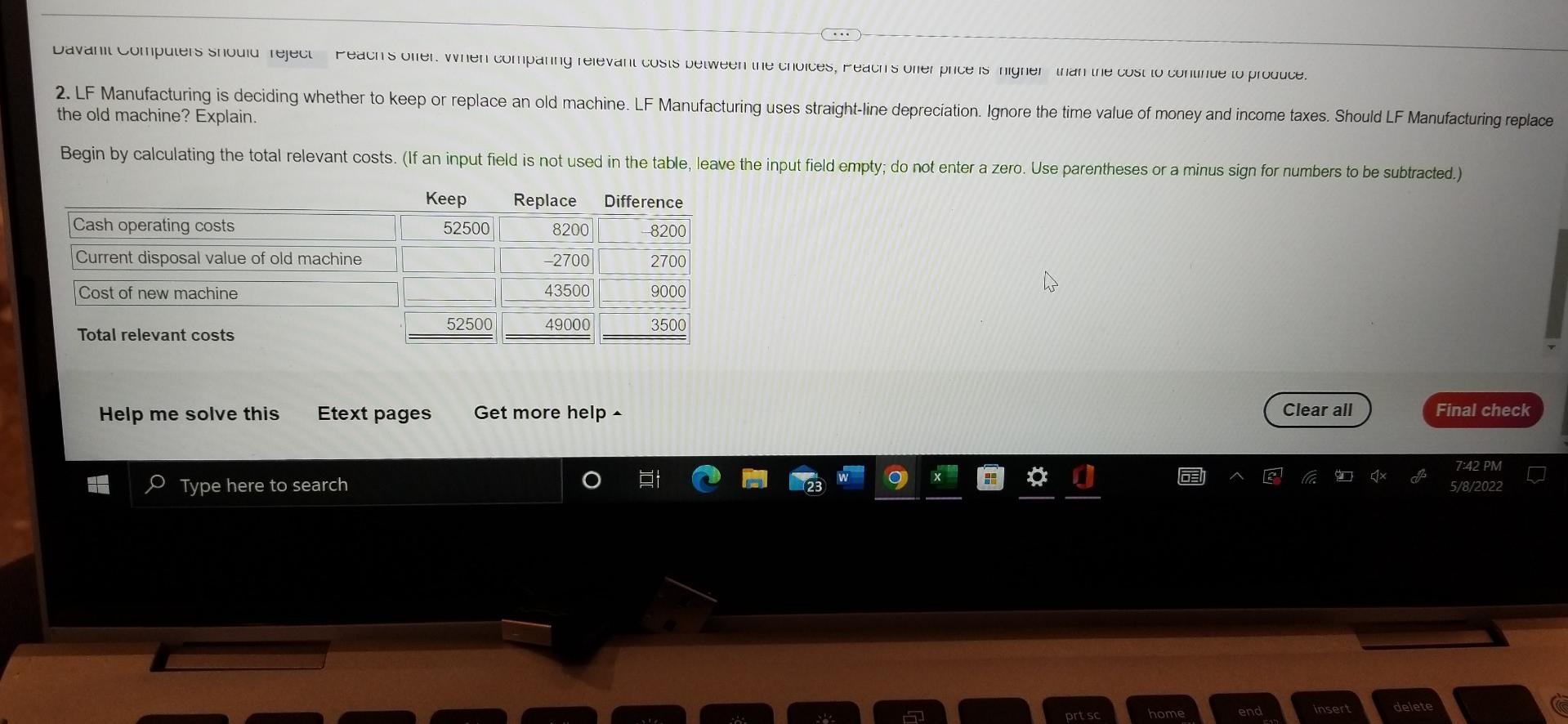

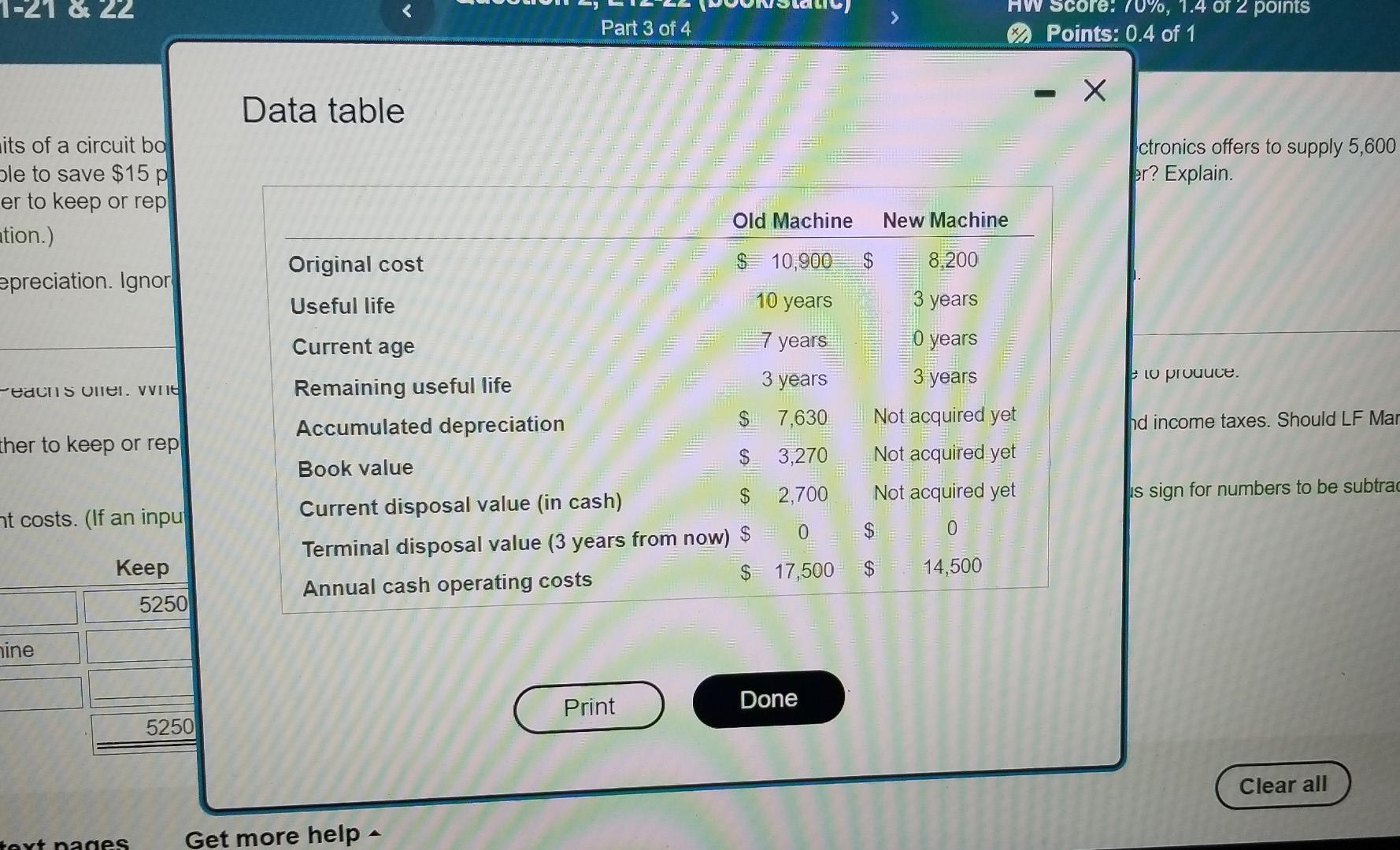

Davam computers should reject Peans ollei vien comparing relevant COSIS Detween ue Choices, reaches oner price is nigne udn the cost LO CONNUE to produce. 2. LF Manufacturing is deciding whether to keep or replace an old machine. LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. Begin by calculating the total relevant costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.) Keep Difference Replace 8200 52500 8200 Cash operating costs Current disposal value of old machine -2700 2700 43500 Cost of new machine W 9000 52500 49000 3500 Total relevant costs Help me solve this Etext pages Get more help Clear all Final check W O BL DEN C4 Type here to search 7:42 PM 5/8/2022 23 E end insert prt sc home delete > Part 3 of 4 HW Score: 70%, 1.4 of 2 points Points: 0.4 of 1 X Data table ctronics offers to supply 5,600 er? Explain. its of a circuit bo ble to save $15 p er to keep or rep ation.) Old Machine New Machine Original cost $ 10,900 $ 8.200 epreciation. Ignor Useful life 10 years 7 years 3 years 10 prouuce. -edcnS ollei. VnE 7,630 3 years O years 3 years Not acquired yet Not acquired yet Not acquired yet nd income taxes. Should LF Mar Current age Remaining useful life Accumulated depreciation Book value Current disposal value (in cash) $ Terminal disposal value (3 years from now) $ Annual cash operating costs ther to keep or rep 3,270 2,700 is sign for numbers to be subtrac at costs. (If an inpu 0 $ 0 Keep $ 17,500 $ 14,500 5250 nine Print Done 5250 Clear all evt nades Get more help Davam computers should reject Peans ollei vien comparing relevant COSIS Detween ue Choices, reaches oner price is nigne udn the cost LO CONNUE to produce. 2. LF Manufacturing is deciding whether to keep or replace an old machine. LF Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LF Manufacturing replace the old machine? Explain. Begin by calculating the total relevant costs. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.) Keep Difference Replace 8200 52500 8200 Cash operating costs Current disposal value of old machine -2700 2700 43500 Cost of new machine W 9000 52500 49000 3500 Total relevant costs Help me solve this Etext pages Get more help Clear all Final check W O BL DEN C4 Type here to search 7:42 PM 5/8/2022 23 E end insert prt sc home delete > Part 3 of 4 HW Score: 70%, 1.4 of 2 points Points: 0.4 of 1 X Data table ctronics offers to supply 5,600 er? Explain. its of a circuit bo ble to save $15 p er to keep or rep ation.) Old Machine New Machine Original cost $ 10,900 $ 8.200 epreciation. Ignor Useful life 10 years 7 years 3 years 10 prouuce. -edcnS ollei. VnE 7,630 3 years O years 3 years Not acquired yet Not acquired yet Not acquired yet nd income taxes. Should LF Mar Current age Remaining useful life Accumulated depreciation Book value Current disposal value (in cash) $ Terminal disposal value (3 years from now) $ Annual cash operating costs ther to keep or rep 3,270 2,700 is sign for numbers to be subtrac at costs. (If an inpu 0 $ 0 Keep $ 17,500 $ 14,500 5250 nine Print Done 5250 Clear all evt nades Get more help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts