Question: 2 . It is August 1 0 and Farmer John is making final estimates of this year's wheat crop. His production is turning out to

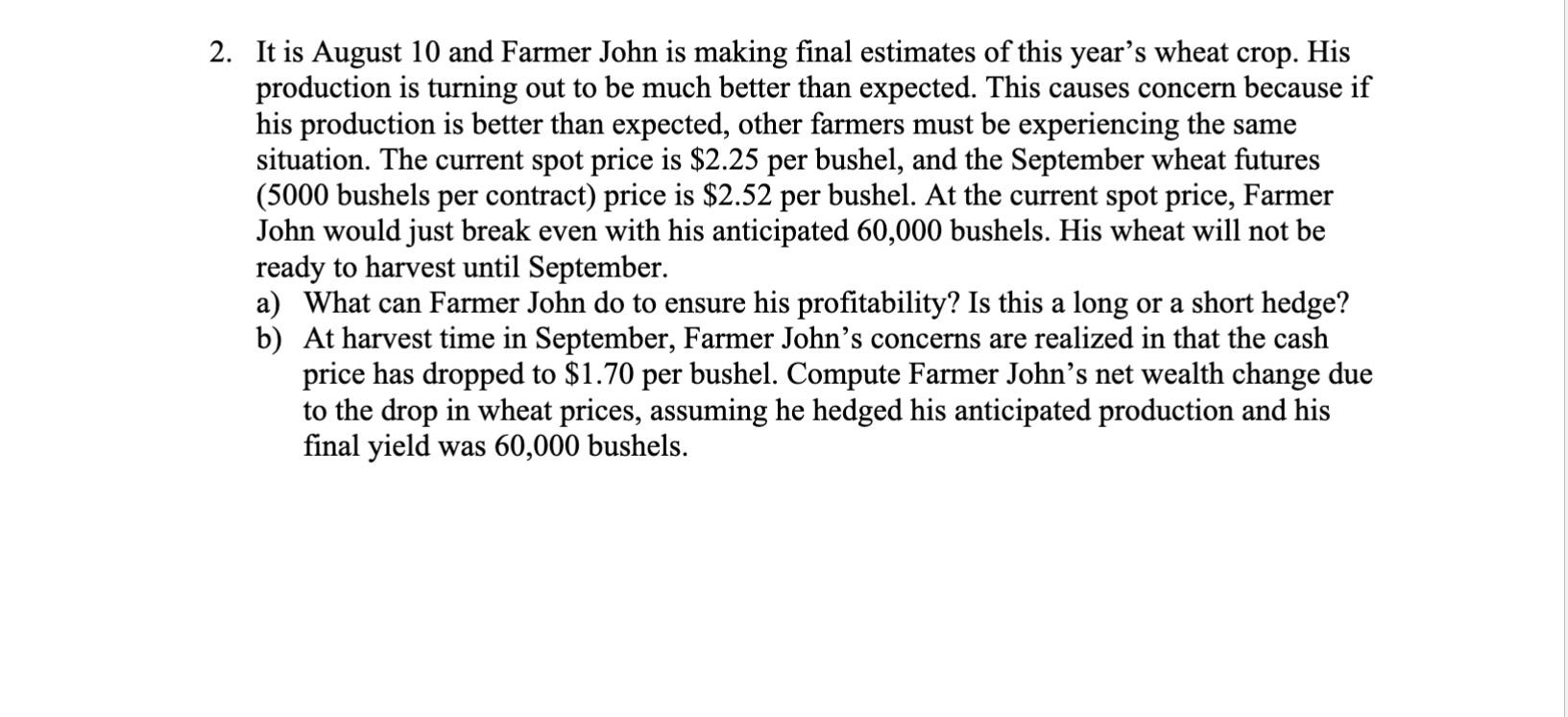

It is August and Farmer John is making final estimates of this year's wheat crop. His production is turning out to be much better than expected. This causes concern because if his production is better than expected, other farmers must be experiencing the same situation. The current spot price is $ per bushel, and the September wheat futures bushels per contract price is $ per bushel. At the current spot price, Farmer John would just break even with his anticipated bushels. His wheat will not be ready to harvest until September. a What can Farmer John do to ensure his profitability? Is this a long or a short hedge? b At harvest time in September, Farmer John's concerns are realized in that the cash price has dropped to $ per bushel. Compute Farmer John's net wealth change due to the drop in wheat prices, assuming he hedged his anticipated production and his final yield was bushels.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock