Question: 2. Kellerman Farm Supply, Inc., has both cash sales and credit sales. Half of each month's sales is for cash and all credit sales are

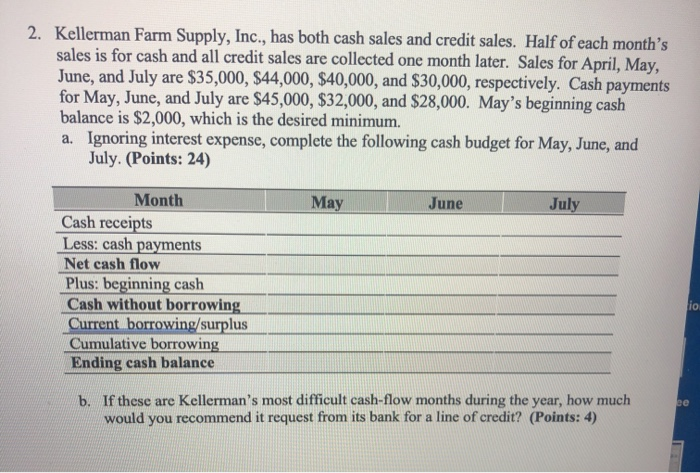

2. Kellerman Farm Supply, Inc., has both cash sales and credit sales. Half of each month's sales is for cash and all credit sales are collected one month later. Sales for April, May. June, and July are $35,000, $44,000, $40,000, and $30,000, respectively. Cash payments for May, June, and July are $45,000, $32,000, and $28,000. May's beginning cash balance is $2,000, which is the desired minimum a. Ignoring interest expense, complete the following cash budget for May, June, and July. (Points: 24) May June July Month Cash receipts Less: cash payments Net cash flow Plus: beginning cash Cash without borrowing Current borrowing/surplus Cumulative borrowing Ending cash balance b. If these are Kellerman's most difficult cash-flow months during the year, how much would you recommend it request from its bank for a line of credit? (Points: 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts