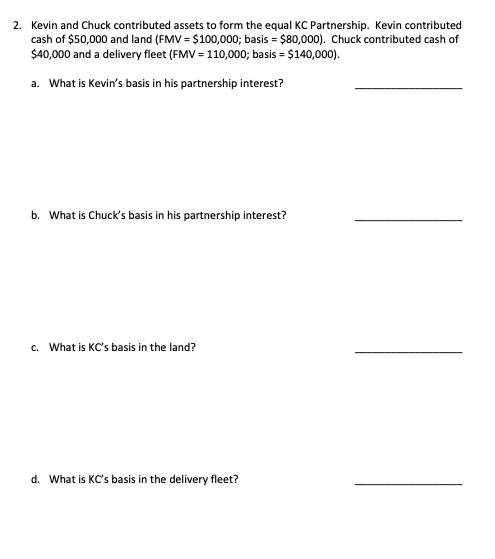

Question: 2. Kevin and Chuck contributed assets to form the equal KC Partnership. Kevin contributed cash of $50,000 and land (FMV = $100,000; basis = $80,000).

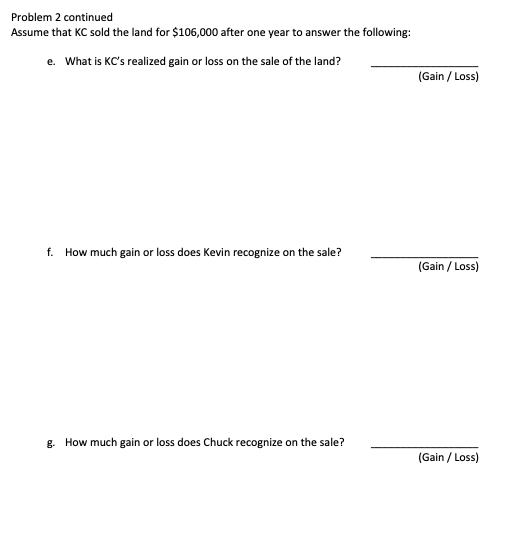

2. Kevin and Chuck contributed assets to form the equal KC Partnership. Kevin contributed cash of $50,000 and land (FMV = $100,000; basis = $80,000). Chuck contributed cash of $40,000 and a delivery fleet (FMV = 110,000; basis = $140,000). a. What is Kevin's basis in his partnership interest? b. What is Chuck's basis in his partnership interest? C. What is KC's basis in the land? d. What is KC's basis in the delivery fleet? Problem 2 continued Assume that KC sold the land for $106,000 after one year to answer the following: e. What is KC's realized gain or loss on the sale of the land? (Gain / Loss) f. How much gain or loss does Kevin recognize on the sale? (Gain / Loss) 8. How much gain or loss does Chuck recognize on the sale? (Gain / Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts