Question: 2. Key Formulas A. Variance and Standard Costing. 1. Direct Materials Price Variance = (Actual Price - Standard Price) X Actual Quantity 2. Direct Materials

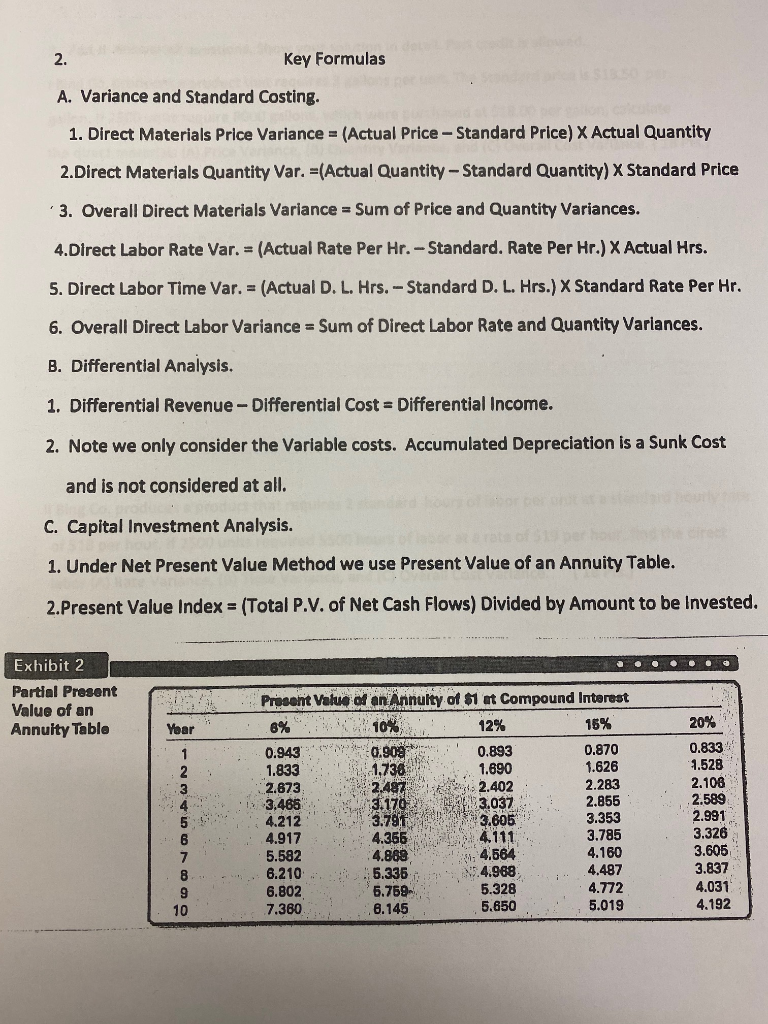

2. Key Formulas A. Variance and Standard Costing. 1. Direct Materials Price Variance = (Actual Price - Standard Price) X Actual Quantity 2. Direct Materials Quantity Var. =(Actual Quantity - Standard Quantity) X Standard Price 3. Overall Direct Materials Variance = Sum of Price and Quantity Variances. 4.Direct Labor Rate Var. = (Actual Rate Per Hr. - Standard. Rate Per Hr.) X Actual Hrs. 5. Direct Labor Time Var. = (Actual D. L. Hrs. - Standard D. L. Hrs.) X Standard Rate Per Hr. 6. Overall Direct Labor Variance = Sum of Direct Labor Rate and Quantity Variances. B. Differential Analysis. 1. Differential Revenue - Differential Cost = Differential Income. 2. Note we only consider the Variable costs. Accumulated Depreciation is a Sunk Cost and is not considered at all. C. Capital Investment Analysis. 1. Under Net Present Value Method we use Present Value of an Annuity Table. 2.Present Value Index = (Total P.V. of Net Cash Flows) Divided by Amount to be invested. . . . Exhibit 2 Partial Present Value of an Annuity Tablo 20% 0.833 Year 1 2 3 1.528 Present Value of an Annuity of $1 at Compound Interest 8% 10% 12% 15% 0.943 0.903 0.893 0.870 1.833 1.736 1.690 1.626 2.873 2.487 2.402 2.283 3.466 3.170 3.037 2.855 4.212 13.605 3.353 4.917 4.111 3.785 5.582 4.889 4.160 6.210 5.336 W.4.988 4.487 6.802 5.759 5.328 4.772 7.360 6.145 5.650 5.019 5 3.787 4.366 2.108 2.589 2.991 3.326 3.605 3.837 4.031 6 7 8 9 10 4.564 4.192 2. Key Formulas A. Variance and Standard Costing. 1. Direct Materials Price Variance = (Actual Price - Standard Price) X Actual Quantity 2. Direct Materials Quantity Var. =(Actual Quantity - Standard Quantity) X Standard Price 3. Overall Direct Materials Variance = Sum of Price and Quantity Variances. 4.Direct Labor Rate Var. = (Actual Rate Per Hr. - Standard. Rate Per Hr.) X Actual Hrs. 5. Direct Labor Time Var. = (Actual D. L. Hrs. - Standard D. L. Hrs.) X Standard Rate Per Hr. 6. Overall Direct Labor Variance = Sum of Direct Labor Rate and Quantity Variances. B. Differential Analysis. 1. Differential Revenue - Differential Cost = Differential Income. 2. Note we only consider the Variable costs. Accumulated Depreciation is a Sunk Cost and is not considered at all. C. Capital Investment Analysis. 1. Under Net Present Value Method we use Present Value of an Annuity Table. 2.Present Value Index = (Total P.V. of Net Cash Flows) Divided by Amount to be invested. . . . Exhibit 2 Partial Present Value of an Annuity Tablo 20% 0.833 Year 1 2 3 1.528 Present Value of an Annuity of $1 at Compound Interest 8% 10% 12% 15% 0.943 0.903 0.893 0.870 1.833 1.736 1.690 1.626 2.873 2.487 2.402 2.283 3.466 3.170 3.037 2.855 4.212 13.605 3.353 4.917 4.111 3.785 5.582 4.889 4.160 6.210 5.336 W.4.988 4.487 6.802 5.759 5.328 4.772 7.360 6.145 5.650 5.019 5 3.787 4.366 2.108 2.589 2.991 3.326 3.605 3.837 4.031 6 7 8 9 10 4.564 4.192

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts