Question: 2. Let 0 < K < K2. In the Black-Scholes market, consider the contingent claim X that pays one unit of the currency, provided

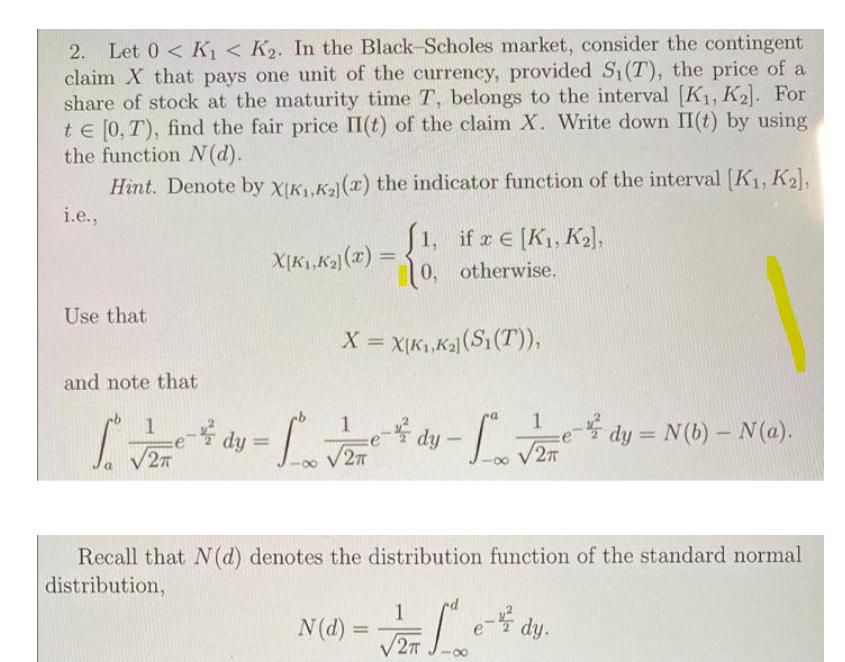

2. Let 0 < K < K2. In the Black-Scholes market, consider the contingent claim X that pays one unit of the currency, provided S(T), the price of a share of stock at the maturity time T, belongs to the interval [K1, K2). For te [0, T), find the fair price II(t) of the claim X. Write down II(t) by using the function N(d). Hint. Denote by XIK1.Ka)(x) the indicator function of the interval [K1, K2), i.e., X[K1,K2) (x) : S1, if z E (K1, K2), 0, otherwise. %3D Use that X = X[K1,Ka (S1(T)), and note that dy Le- dy = N(b) N(a). V27 1 dy : %3D %3D 27 27 Recall that N (d) denotes the distribution function of the standard normal distribution, 1 N(d) = dy.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step by step solution 1A x el ... View full answer

Get step-by-step solutions from verified subject matter experts