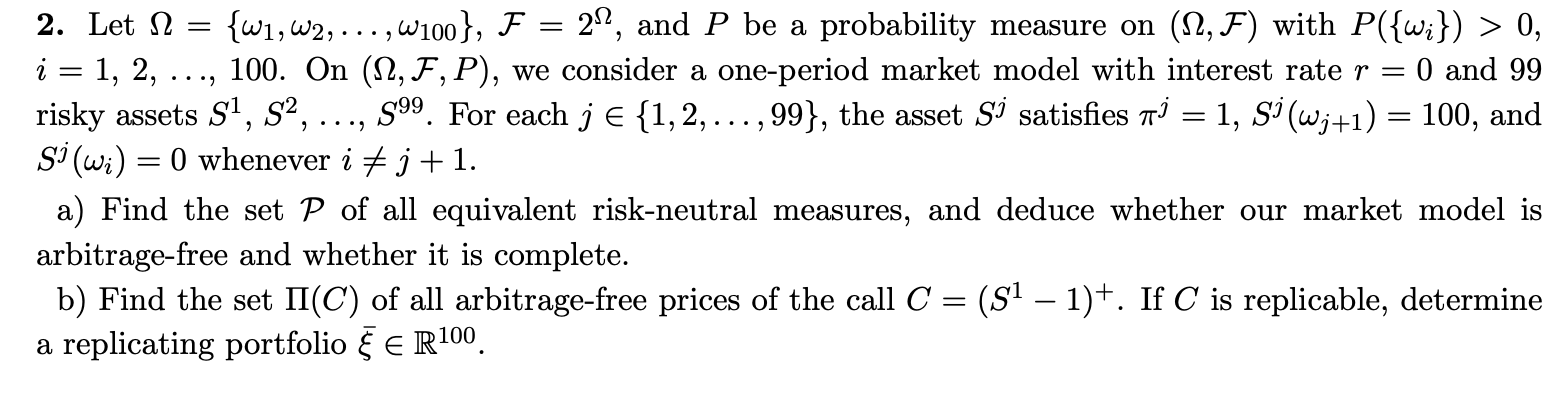

Question: 2. Let N = {w1, W2, ..., W100), F = 232, and P be a probability measure on (12, F) with P({wi}) > 0, i

2. Let N = {w1, W2, ..., W100), F = 232, and P be a probability measure on (12, F) with P({wi}) > 0, i = 1, 2, ..., 100. On (12, F, P), we consider a one-period market model with interest rate r = 0 and 99 risky assets S1, S2, ..., S99. For each j e {1,2, ...,99}, the asset Si satisfies i = 1, si (Wj+1) = 100, and Si (wi) = 0 whenever i # j +1. a) Find the set P of all equivalent risk-neutral measures, and deduce whether our market model is arbitrage-free and whether it is complete. b) Find the set II(C) of all arbitrage-free prices of the call C = (si 1)+. If C is replicable, determine a replicating portfolio & E R100. 2. Let N = {w1, W2, ..., W100), F = 232, and P be a probability measure on (12, F) with P({wi}) > 0, i = 1, 2, ..., 100. On (12, F, P), we consider a one-period market model with interest rate r = 0 and 99 risky assets S1, S2, ..., S99. For each j e {1,2, ...,99}, the asset Si satisfies i = 1, si (Wj+1) = 100, and Si (wi) = 0 whenever i # j +1. a) Find the set P of all equivalent risk-neutral measures, and deduce whether our market model is arbitrage-free and whether it is complete. b) Find the set II(C) of all arbitrage-free prices of the call C = (si 1)+. If C is replicable, determine a replicating portfolio & E R100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts