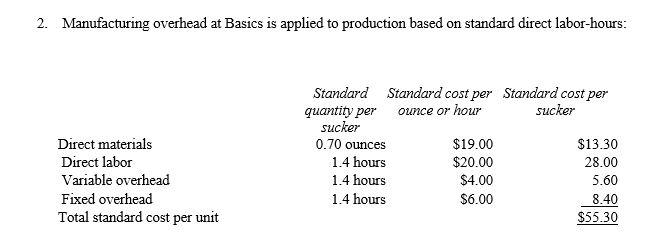

Question: 2. Manufacturing overhead at Basics is applied to production based on standard direct labor-hours: Direct materials Direct labor Variable overhead Fixed overhead Total standard cost

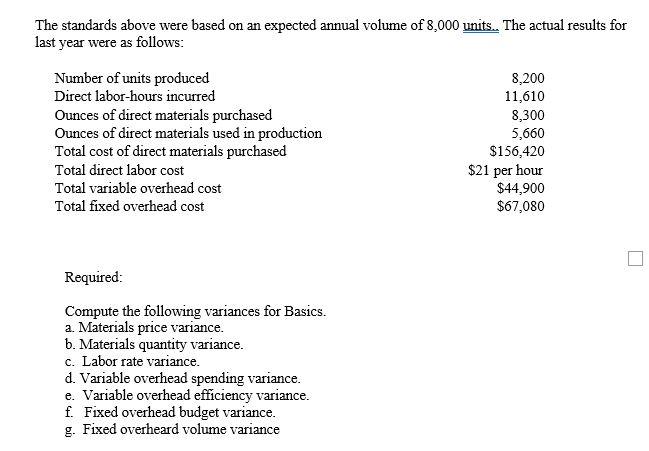

2. Manufacturing overhead at Basics is applied to production based on standard direct labor-hours: Direct materials Direct labor Variable overhead Fixed overhead Total standard cost per unit Standard Standard cost per Standard cost per quantity per ounce or hour sucker sucker 0.70 ounces $19.00 $13.30 1.4 hours $20.00 28.00 1.4 hours $4.00 5.60 1.4 hours $6.00 8.40 $55.30 The standards above were based on an expected annual volume of 8,000 units.. The actual results for last year were as follows: Number of units produced Direct labor-hours incurred Ounces of direct materials purchased Ounces of direct materials used in production Total cost of direct materials purchased Total direct labor cost Total variable overhead cost Total fixed overhead cost 8,200 11,610 8,300 5,660 $156,420 $21 per hour $44,900 $67,080 Required: Compute the following variances for Basics. a. Materials price variance. b. Materials quantity variance. c. Labor rate variance. d. Variable overhead spending variance. e. Variable overhead efficiency variance. f. Fixed overhead budget variance. g. Fixed overheard volume variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts