Question: 2. Monte Carlo Simulation (20') Please illustrate the Four Steps of pricing the basket option via Monte Carlo Simulation. A basket option is a type

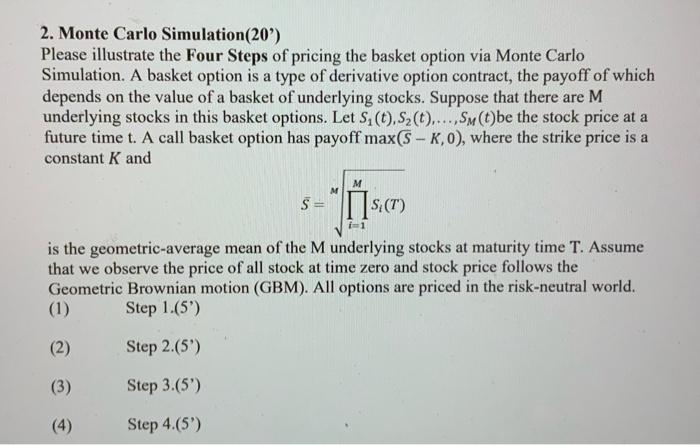

2. Monte Carlo Simulation (20') Please illustrate the Four Steps of pricing the basket option via Monte Carlo Simulation. A basket option is a type of derivative option contract, the payoff of which depends on the value of a basket of underlying stocks. Suppose that there are M underlying stocks in this basket options. Let S (t), S (t)....,SM (t)be the stock price at a future time t. A call basket option has payoff max(S-K, 0), where the strike price is a constant K and S="S(T) i=1 is the geometric-average mean of the M underlying stocks at maturity time T. Assume that we observe the price of all stock at time zero and stock price follows the Geometric Brownian motion (GBM). All options are priced in the risk-neutral world. (1) Step 1.(5') (2) Step 2.(5') (3) Step 3.(5') (4) Step 4.(5') 2. Monte Carlo Simulation (20') Please illustrate the Four Steps of pricing the basket option via Monte Carlo Simulation. A basket option is a type of derivative option contract, the payoff of which depends on the value of a basket of underlying stocks. Suppose that there are M underlying stocks in this basket options. Let S (t), S (t)....,SM (t)be the stock price at a future time t. A call basket option has payoff max(S-K, 0), where the strike price is a constant K and S="S(T) i=1 is the geometric-average mean of the M underlying stocks at maturity time T. Assume that we observe the price of all stock at time zero and stock price follows the Geometric Brownian motion (GBM). All options are priced in the risk-neutral world. (1) Step 1.(5') (2) Step 2.(5') (3) Step 3.(5') (4) Step 4.(5')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts