Question: 2. Net present value (NPV) Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common

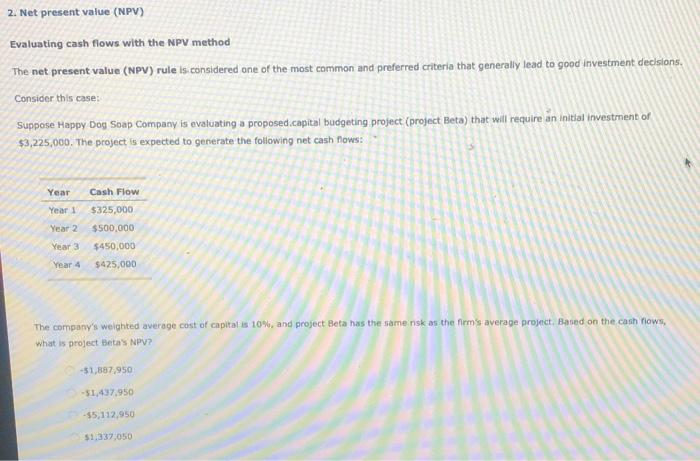

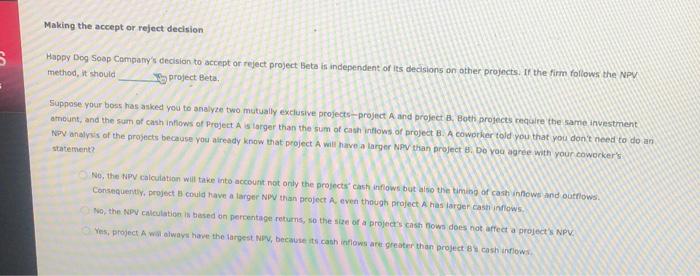

2. Net present value (NPV) Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Happy Dog Soap Company is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $3,225,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $325,000 $500,000 Year 2 Year 3 Year 4 $450,000 $425,000 The company's weighted average cost of capitat is 10%, and project Beta has the same risk as the firm's average promet. Based on the cash nows, what is project Beta's NPV? -$1,887:950 -51.437.950 -$5,112,950 $1,337,050 Making the accept or reject decision S Happy Dog Soap Company's decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta. Suppose your boss has asked you to analyze two mutually exclusive projects-project A and project 8. Both projects require the same investment amount, and the sum of cash inflows of Project As targer than the sum of cash inflows of project B. A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project A will have a larger NPV than projects. Do you agree with your coworker's statement No, the NPV calculation will take into account not only the projects cash flows but also the timing of cash inhows and outflows Consequently, project could have a larger NPV than project A even though project has targer cash flows No, the NPV calculation is based on percentage returns, so the sure of a projects cash rows does not affect a project's NPV. Yes, project A will always have the largest NPV, because its chinos are greater than project B cash now method, it should any's decision to accept or rej Why project Beta. reject Suppose your bos ed you to analyze two mutua amount, and the s accept sh inflows of Project A is large NPV analysis of the projects because you already know th statement? No, the NPV calculation will take into account not Consequently, proierto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts