Question: 2. Nonconstant DDM Work the Web and use Excel Estimate the cost of equity or required return for Coca-Cola (KO) using the CAPM. (Use 10-year

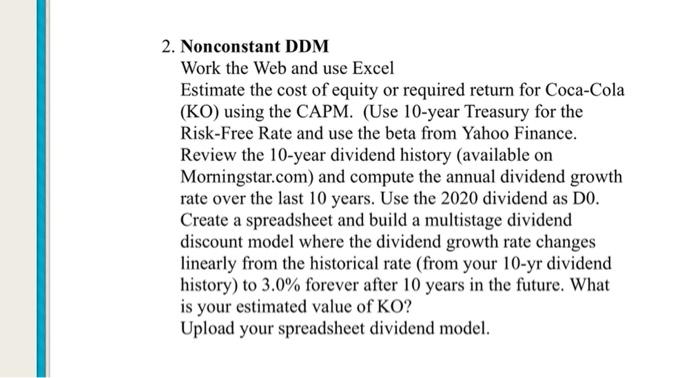

2. Nonconstant DDM Work the Web and use Excel Estimate the cost of equity or required return for Coca-Cola (KO) using the CAPM. (Use 10-year Treasury for the Risk-Free Rate and use the beta from Yahoo Finance. Review the 10-year dividend history (available on Morningstar.com) and compute the annual dividend growth rate over the last 10 years. Use the 2020 dividend as DO. Create a spreadsheet and build a multistage dividend discount model where the dividend growth rate changes linearly from the historical rate (from your 10-yr dividend history) to 3.0% forever after 10 years in the future. What is your estimated value of KO? Upload your spreadsheet dividend model. 2. Nonconstant DDM Work the Web and use Excel Estimate the cost of equity or required return for Coca-Cola (KO) using the CAPM. (Use 10-year Treasury for the Risk-Free Rate and use the beta from Yahoo Finance. Review the 10-year dividend history (available on Morningstar.com) and compute the annual dividend growth rate over the last 10 years. Use the 2020 dividend as DO. Create a spreadsheet and build a multistage dividend discount model where the dividend growth rate changes linearly from the historical rate (from your 10-yr dividend history) to 3.0% forever after 10 years in the future. What is your estimated value of KO? Upload your spreadsheet dividend model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts