Question: 2. On Jan, 1 2014, Peter Corp. (a U.S. based company) formed a new subsidiary in Saudi Arabia, Saeed Inc., with an initial investment of

2. On Jan, 1 2014, Peter Corp. (a U.S. based company) formed a new subsidiary in Saudi Arabia, Saeed Inc., with an initial investment of 30,000 SAR.

Assume Saeed Inc.

Purchases inventory evenly throughout 2014. The ending inventory is purchased Nov. 30, 2014.

Uses straight-line depreciation on fixed assets.

Declares and pays dividends on Nov. 30, 2014.

Purchased the fixed assets on April 1, 2014.

Uses SAR as the functional currency.

Exchange Rates are given:

Jan 1, 2014 0.260

April 1, 2014 0.255

Nov. 30, 2014 0.240

Dec. 31, 2014 0.238

REQUIRED

Prepare a schedule to translate Saeeds financial statements on Dec. 31, 2014 to U.S. dollars.

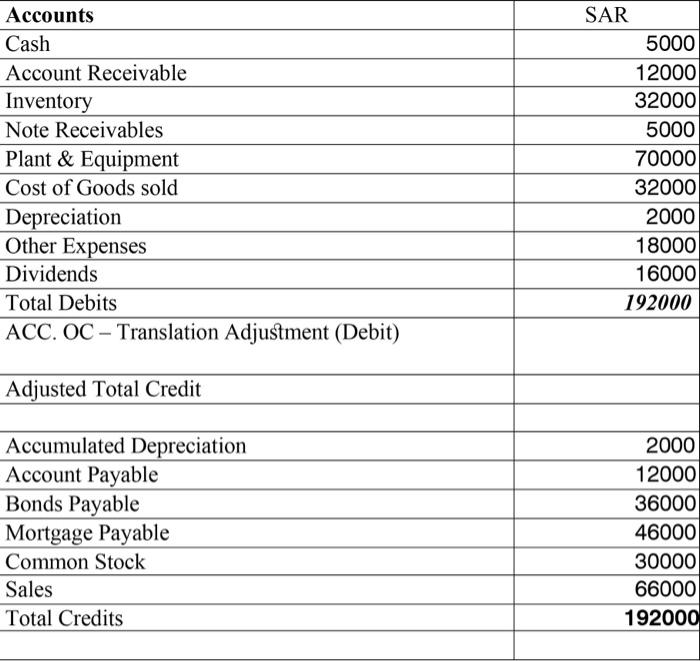

Accounts Cash Account Receivable Inventory Note Receivables Plant & Equipment Cost of Goods sold Depreciation Other Expenses Dividends Total Debits ACC. OC - Translation Adjustment (Debit) SAR 5000 12000 32000 5000 70000 32000 2000 18000 16000 192000 Adjusted Total Credit Accumulated Depreciation Account Payable Bonds Payable Mortgage Payable Common Stock Sales Total Credits 2000 12000 36000 46000 30000 66000 192000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts