Question: 2. On January 1, 2016, Blaugh Co. signed a long-term lease for an office building. The terms of the lease required Blaugh to pay

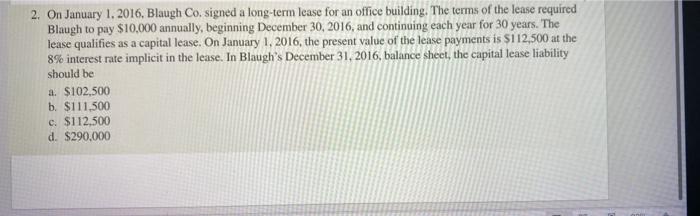

2. On January 1, 2016, Blaugh Co. signed a long-term lease for an office building. The terms of the lease required Blaugh to pay $10,000 annually, beginning December 30, 2016, and continuing each year for 30 years. The lease qualifies as a capital lease. On January 1, 2016, the present value of the lease payments is $112,500 at the 8% interest rate implicit in the lease. In Blaugh's December 31, 2016, balance sheet, the capital lease liability should be a. $102,500 b. $111,500 c. $112,500 d. $290,000

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Principal payment in Year 1 Total payment Interest pa... View full answer

Get step-by-step solutions from verified subject matter experts