Question: 2) on june 30 2022 the company sold old equipment for $33600. the equipment originally cost 50400 and had accumulated depreciation to the date of

2) on june 30 2022 the company sold old equipment for $33600. the equipment originally cost 50400 and had accumulated depreciation to the date of disposal of $21000. prepare the journal entries on september 30 and june 30 2022.

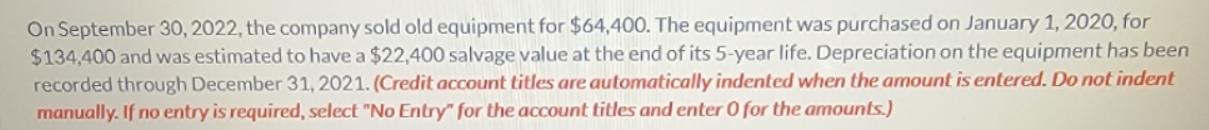

On September 30, 2022, the company sold old equipment for $64,400. The equipment was purchased on January 1, 2020, for $134,400 and was estimated to have a $22,400 salvage value at the end of its 5-year life. Depreciation on the equipment has been recorded through December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

September 30 2022 Debit Gain on Sale of Equipme... View full answer

Get step-by-step solutions from verified subject matter experts