Question: 2. Option pricing using the binomial model (a) The SEK/USD exchange rate is 9.15, the one-year interest rate in Sweden is 0.25% and the one-year

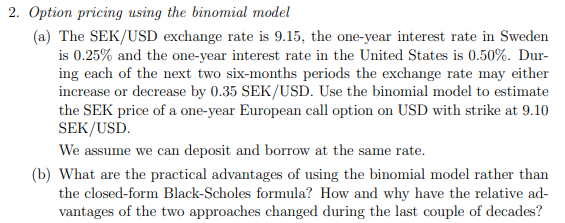

2. Option pricing using the binomial model (a) The SEK/USD exchange rate is 9.15, the one-year interest rate in Sweden is 0.25% and the one-year interest rate in the United States is 0.50%. Dur- ing each of the next two six-months periods the exchange rate may either increase or decrease by 0.35 SEK/USD. Use the binomial model to estimate the SEK price of a one-year European call option on USD with strike at 9.10 SEK/USD. We assume we can deposit and borrow at the same rate. (b) What are the practical advantages of using the binomial model rather than the closed-form Black-Scholes formula? How and why have the relative ad- vantages of the two approaches changed during the last couple of decades

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts