Question: 2. Option Valuation (20 Marks) There are two call options with the same underlying stock but different exercise prices. The exercise price for Option One

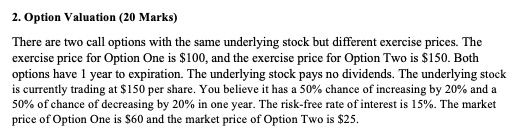

2. Option Valuation (20 Marks) There are two call options with the same underlying stock but different exercise prices. The exercise price for Option One is $100, and the exercise price for Option Two is $150. Both options have 1 year to expiration. The underlying stock pays no dividends. The underlying stock is currently trading at $150 per share. You believe it has a 50% chance of increasing by 20% and a 50% of chance of decreasing by 20% in one year. The risk-free rate of interest is 15%. The market price of Option One is $60 and the market price of Option Two is $25. Calculate & Answer: ). What is the hedge ratio for Option One and Option Two, respectively? (4 Marks) 2. Option Valuation (20 Marks) There are two call options with the same underlying stock but different exercise prices. The exercise price for Option One is $100, and the exercise price for Option Two is $150. Both options have 1 year to expiration. The underlying stock pays no dividends. The underlying stock is currently trading at $150 per share. You believe it has a 50% chance of increasing by 20% and a 50% of chance of decreasing by 20% in one year. The risk-free rate of interest is 15%. The market price of Option One is $60 and the market price of Option Two is $25. Calculate & Answer: ). What is the hedge ratio for Option One and Option Two, respectively? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts