Question: 2 Payoffs and Arbitrage There are two states, up (u) and down (d), that is S={u,d}. There are two assets. A risk-free asset with (risk-free)

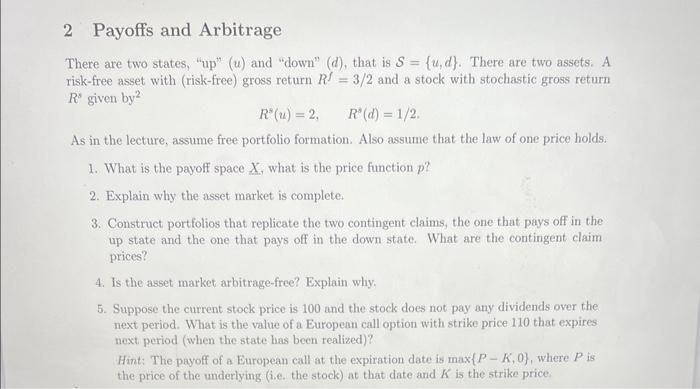

2 Payoffs and Arbitrage There are two states, "up" (u) and "down" (d), that is S={u,d}. There are two assets. A risk-free asset with (risk-free) gross return R=3/2 and a stock with stochastic gross return Rs given by y2 Rs(u)=2,Rs(d)=1/2 As in the lecture, assume free portfolio formation. Also assume that the law of one price holds. 1. What is the payoff space X, what is the price function p ? 2. Explain why the asset market is complete. 3. Construct portfolios that replicate the two contingent claims, the one that pays off in the up state and the one that pays off in the down state. What are the contingent claim prices? 4. Is the asset market arbitrage-free? Explain why. 5. Suppose the current stock price is 100 and the stock does not pay any dividends over the next period. What is the value of a European call option with strike price 110 that expires next period (when the state has been realized)? Hint: The payoff of a European call at the expiration date is max{PK,0}, where P is the price of the underlying (i.e. the stock) at that date and K is the strike price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts