Question: 2 PB10-2 (Static) Calculating Unknowns, Predicting Relationship among Return on Investment, Residual Income, Hurdle Rates [LO 10-4, 10-5] The following is partial information for Tonopah

![Income, Hurdle Rates [LO 10-4, 10-5] The following is partial information for](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e67b13077c5_81866e67b129c2a1.jpg)

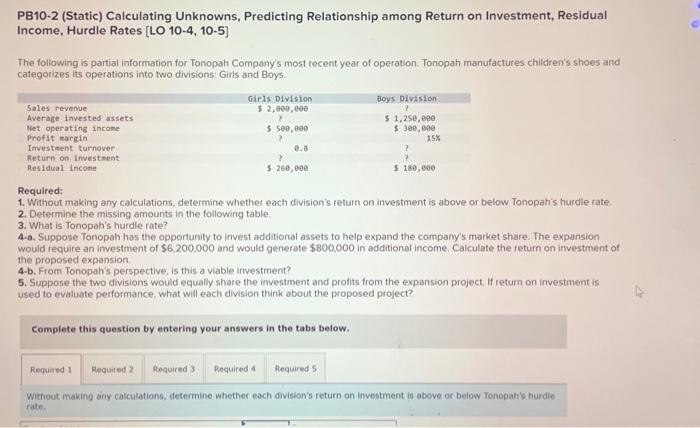

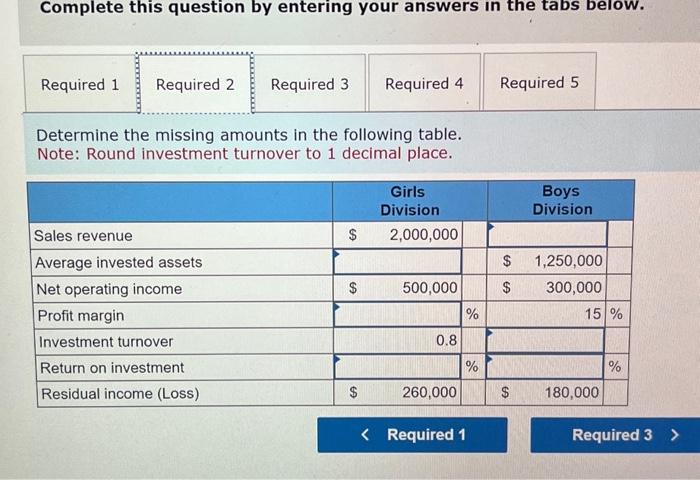

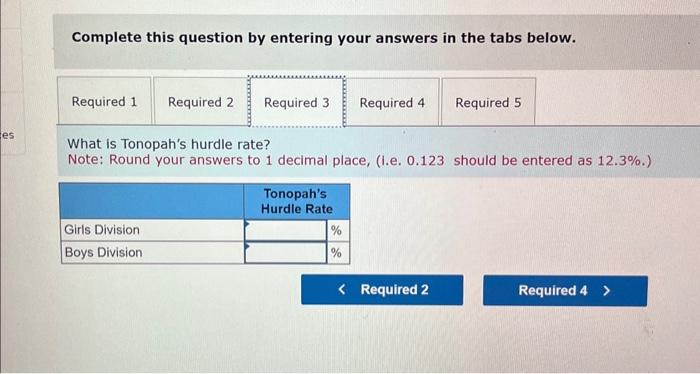

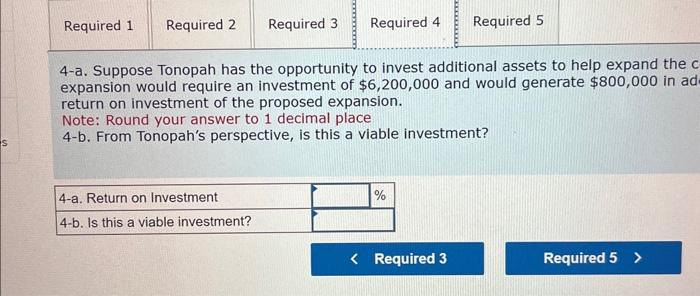

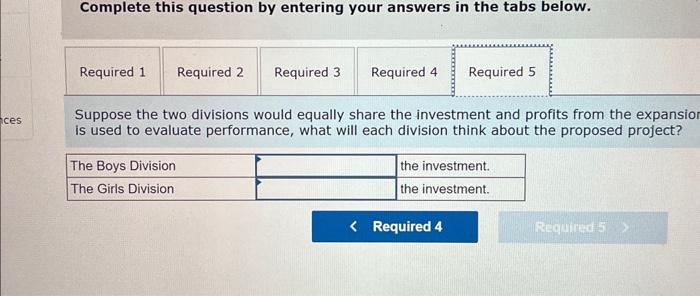

PB10-2 (Static) Calculating Unknowns, Predicting Relationship among Return on Investment, Residual Income, Hurdle Rates [LO 10-4, 10-5] The following is partial information for Tonopah Company's most recent year of operation. Tonopah manufactures chiidren's shoes and categorizes its operations into two divisions: Girls and Boys. Required: 1. Without making any calculations, determine whether each division's feturn on investment is above or below Tonopah's hurdle rate. 2. Determine the missing amounts in the following table. 3. What is Tonopah's hurdle rate? 4-a. Suppose Tonopah has the opportunity to invest additional assets to help expand the company's market share. The expansion would require an investment of $6,200,000 and would generate $800,000 in additional income. Calculate the return on iftvestment of the proposed expansion. 4.b. From Tonopah's perspective, is this a viable investment? 5. Suppose the two divisions would equally share the investment and profits from the expansion project. If return on investment is used to evaluate performance, what will each division think about the proposed project? Complete this question by entering your answers in the tabs below. Without making ainy calculations, determine whether each divislon's return on investment is above or below Tonopah's hurdle rate. Complete this question by entering your answers in the tabs below. Without making any calculations, determine whether each division's return on investment is above rate. Complete this question by entering your answers in the tabs below. Determine the missing amounts in the following table. Note: Round investment turnover to 1 decimal place. Complete this question by entering your answers in the tabs below. What is Tonopah's hurdle rate? Note: Round your answers to 1 decimal place, (i.e. 0.123 should be entered as 12.3%.) 4-a. Suppose Tonopah has the opportunity to invest additional assets to help expand the expansion would require an investment of $6,200,000 and would generate $800,000 in ac return on investment of the proposed expansion. Note: Round your answer to 1 decimal place 4-b. From Tonopah's perspective, is this a viable investment? Complete this question by entering your answers in the tabs below. Suppose the two divisions would equally share the investment and profits from the expansi is used to evaluate performance, what will each division think about the proposed project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts