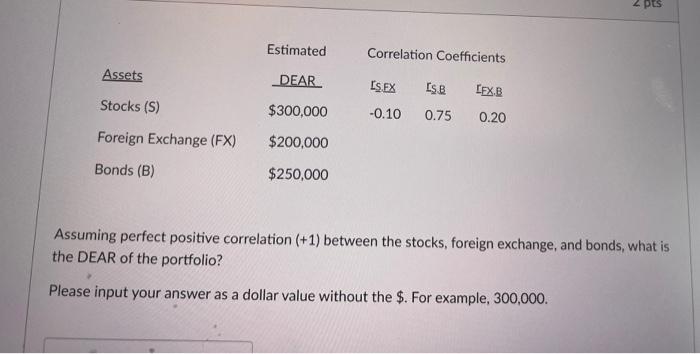

Question: 2 PES Estimated Correlation Coefficients Assets DEAR [S. EX LEX.B Stocks (S) [SB 0.75 $300,000 -0.10 0.20 Foreign Exchange (FX) $200,000 Bonds (B) $250,000 Assuming

2 PES Estimated Correlation Coefficients Assets DEAR [S. EX LEX.B Stocks (S) [SB 0.75 $300,000 -0.10 0.20 Foreign Exchange (FX) $200,000 Bonds (B) $250,000 Assuming perfect positive correlation (+1) between the stocks, foreign exchange, and bonds, what is the DEAR of the portfolio? Please input your answer as a dollar value without the $. For example, 300,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock