Question: 2. Place a question mark next to the variable we are solving for, and finally 3. Input the answer to the variable you are solving

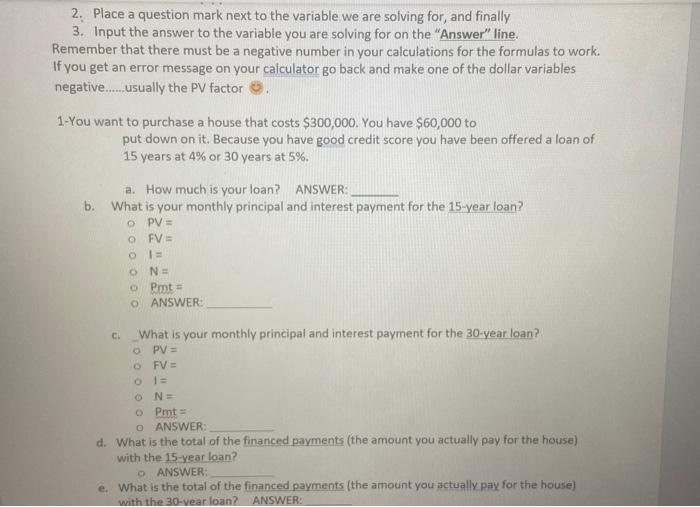

2. Place a question mark next to the variable we are solving for, and finally 3. Input the answer to the variable you are solving for on the "Answer" line. Remember that there must be a negative number in your calculations for the formulas to work. If you get an error message on your calculator go back and make one of the dollar variables negative......usually the PV factor 8 . 1-You want to purchase a house that costs $300,000. You have $60,000 to put down on it. Because you have good credit score you have been offered a loan of 15 years at 4% or 30 years at 5%. a. How much is your loan? ANSWER: b. What is your monthly principal and interest payment for the 15-year loan? PV= FV= I= N= Pmt= ANSWER: c. What is your monthly principal and interest payment for the 30-year loan? PV= FV= 1= N= Pmt= ANSWER: d. What is the total of the financed payments (the amount you actually pay for the house) with the 15 -year loan? e. What is the total of the financed payments (the amount you actually pay for the house)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts