Question: #2 Please answer question and show all work! Thanks everything you need to answer this question is in the question. thanks! 2. There is a

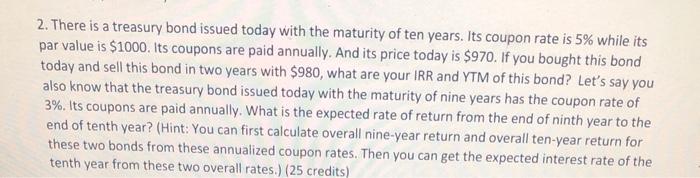

2. There is a treasury bond issued today with the maturity of ten years. Its coupon rate is 5% while its par value is $1000. Its coupons are paid annually. And its price today is $970. If you bought this bond today and sell this bond in two years with $980, what are your IRR and YTM of this bond? Let's say you also know that the treasury bond issued today with the maturity of nine years has the coupon rate of 3%. Its coupons are paid annually. What is the expected rate of return from the end of ninth year to the end of tenth year? (Hint: You can first calculate overall nine-year return and overall ten-year return for these two bonds from these annualized coupon rates. Then you can get the expected interest rate of the tenth year from these two overall rates.) (25 credits)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts