Question: 2. please answer questions completely using multiple choice Grill Works's outstanding preferred stock has a face value of $100 and dividend rate of 5%. It

2.

please answer questions completely using multiple choice

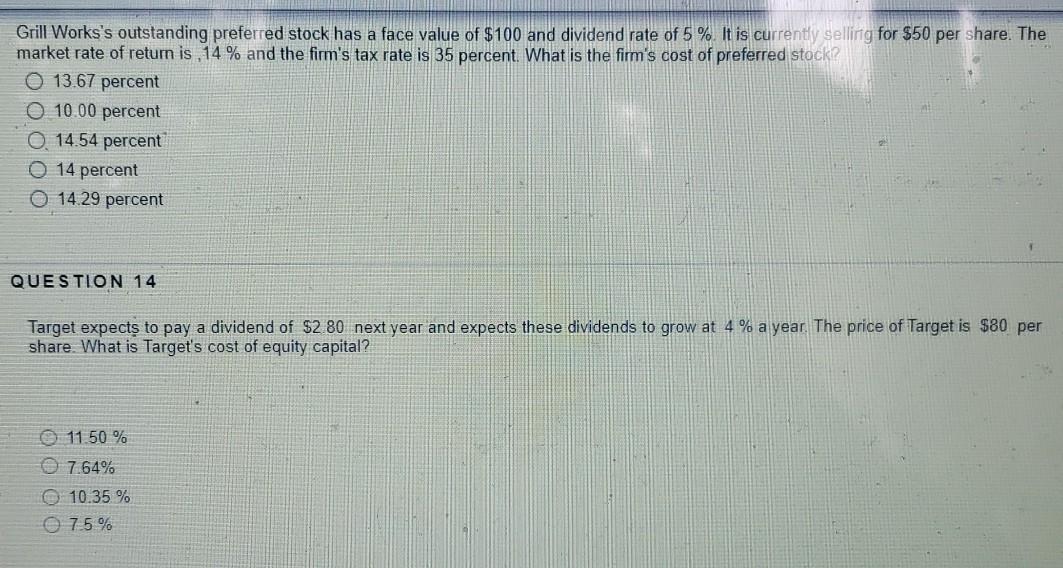

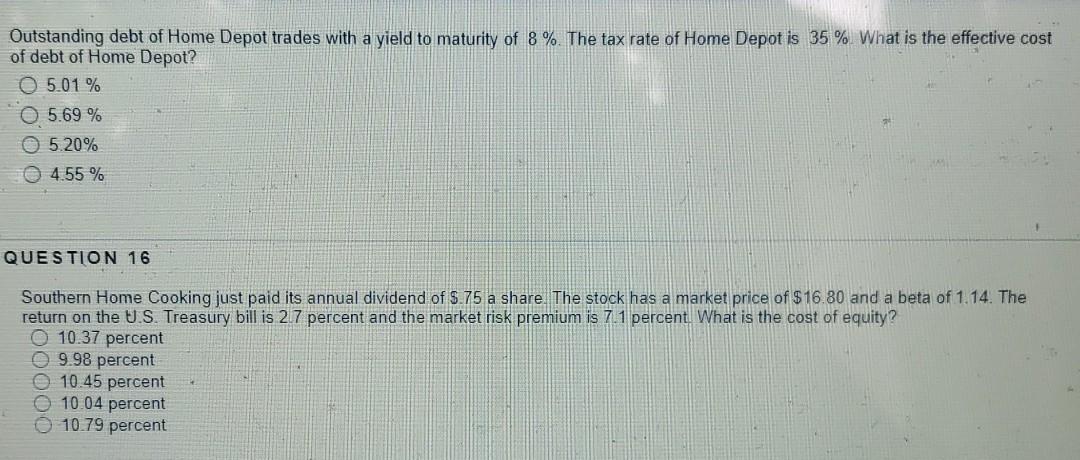

Grill Works's outstanding preferred stock has a face value of $100 and dividend rate of 5%. It is currently selling for $50 per share. The market rate of return is ,14 % and the firm's tax rate is 35 percent. What is the firm's cost of preferred stock? O 13.67 percent O 10.00 percent O 14.54 percent O 14 percent O 14.29 percent QUESTION 14 Target expects to pay a dividend of $2 80 next year and expects these dividends to grow at 4% a year. The price of Target is $80 per share. What is Target's cost of equity capital? 11,50 % 7.64% 10.35% 7.5% Outstanding debt of Home Depot trades with a yield to maturity of 8%. The tax rate of Home Depot is 35 % What is the effective cost of debt of Home Depot? 05.01 % 0 5.69 % 5.20% O 4.55 % QUESTION 16 Southern Home Cooking just paid its annual dividend of $.75 a share. The stock has a market price of $16.30 and a beta of 1.14. The return on the U.S. Treasury bill is 2.7 percent and the market risk premium is 7.1 percent. What is the cost of equity? 10.37 percent 09.98 percent 10.45 percent 10.04 percent 10.79 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts