Question: 2 plese provide ANSWER only no need of calculation What would be the value of this perquisite from the view point of Mr. Chaudary. The

2 plese provide ANSWER only no need of calculation

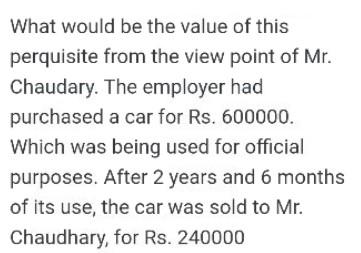

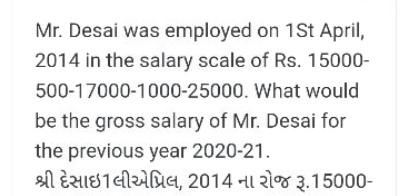

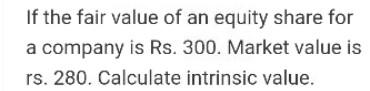

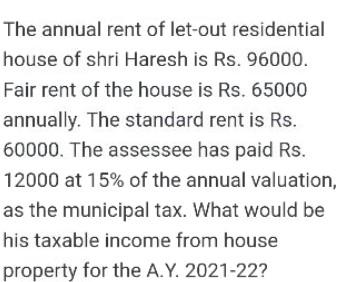

What would be the value of this perquisite from the view point of Mr. Chaudary. The employer had purchased a car for Rs. 600000. Which was being used for official purposes. After 2 years and 6 months of its use, the car was sold to Mr. Chaudhary, for Rs. 240000 Mr. Desai was employed on 1st April, 2014 in the salary scale of Rs. 15000- 500-17000-1000-25000. What would be the gross salary of Mr. Desai for the previous year 2020-21. 1 , 2014 .15000- If the fair value of an equity share for a company is Rs. 300. Market value is rs. 280. Calculate intrinsic value. The annual rent of let-out residential house of shri Haresh is Rs. 96000. Fair rent of the house is Rs. 65000 annually. The standard rent is Rs. 60000. The assessee has paid Rs. 12000 at 15% of the annual valuation, as the municipal tax. What would be his taxable income from house property for the A.Y. 2021-22? Interest on loan for self-occupied house taken before 1st April, 1999 will be allowed up to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts