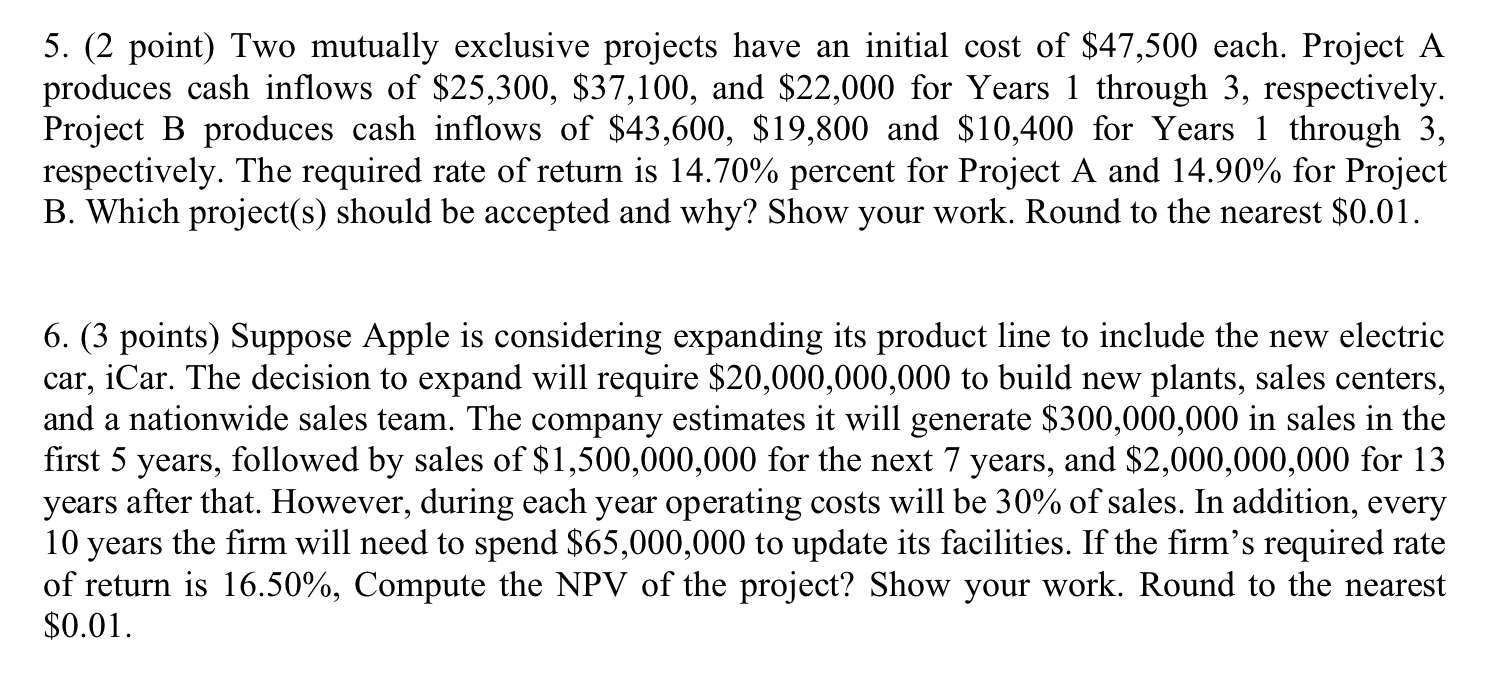

Question: ( 2 point ) Two mutually exclusive projects have an initial cost of $ 4 7 , 5 0 0 each. Project A produces cash

point Two mutually exclusive projects have an initial cost of $ each. Project A

produces cash inflows of $$ and $ for Years through respectively.

Project B produces cash inflows of $$ and $ for Years through

respectively. The required rate of return is percent for Project A and for Project

B Which projects should be accepted and why? Show your work. Round to the nearest $

points Suppose Apple is considering expanding its product line to include the new electric

car, iCar. The decision to expand will require $ to build new plants, sales centers,

and a nationwide sales team. The company estimates it will generate $ in sales in the

first years, followed by sales of $ for the next years, and $ for

years after that. However, during each year operating costs will be of sales. In addition, every

years the firm will need to spend $ to update its facilities. If the firm's required rate

of return is Compute the NPV of the project? Show your work. Round to the nearest

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock