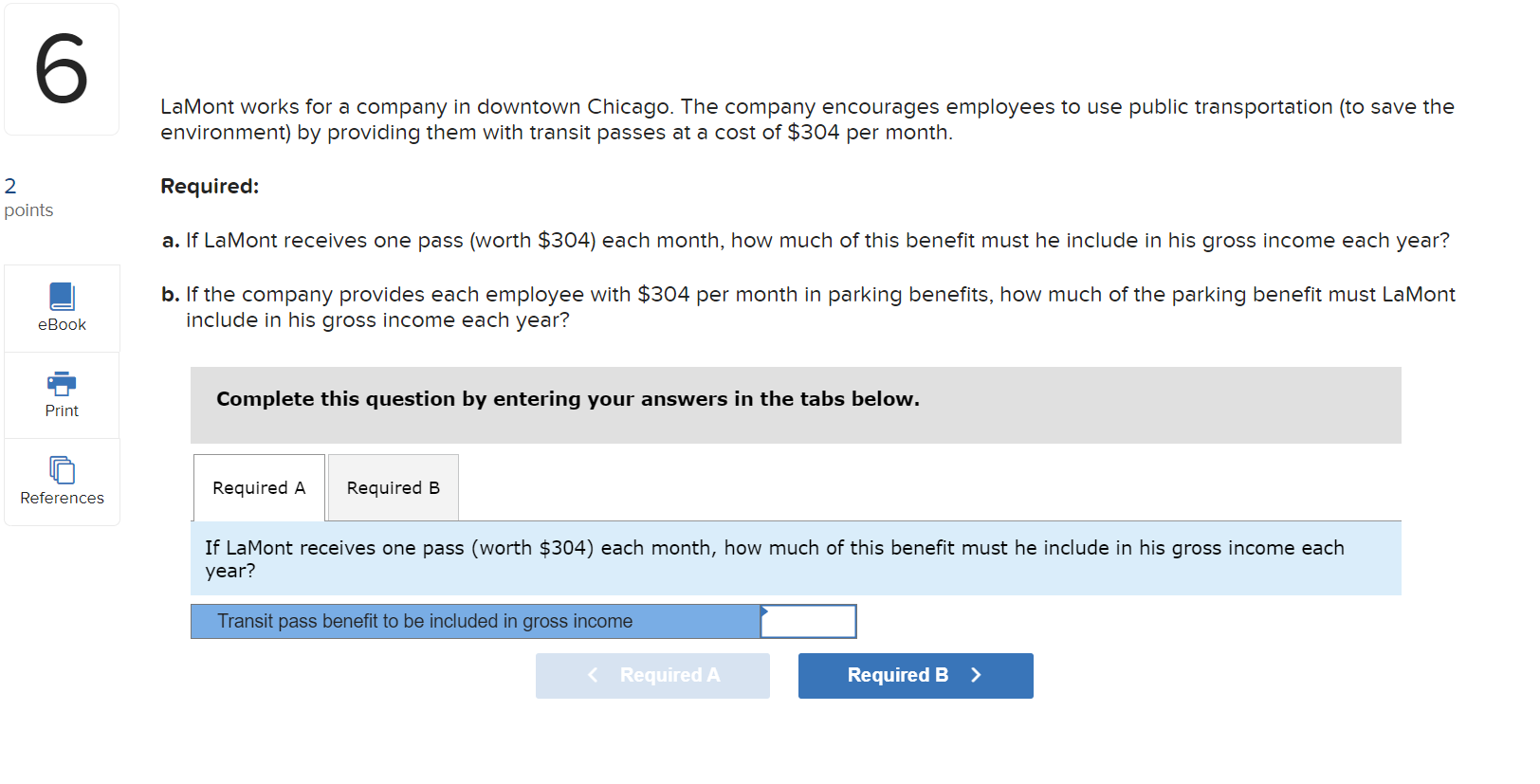

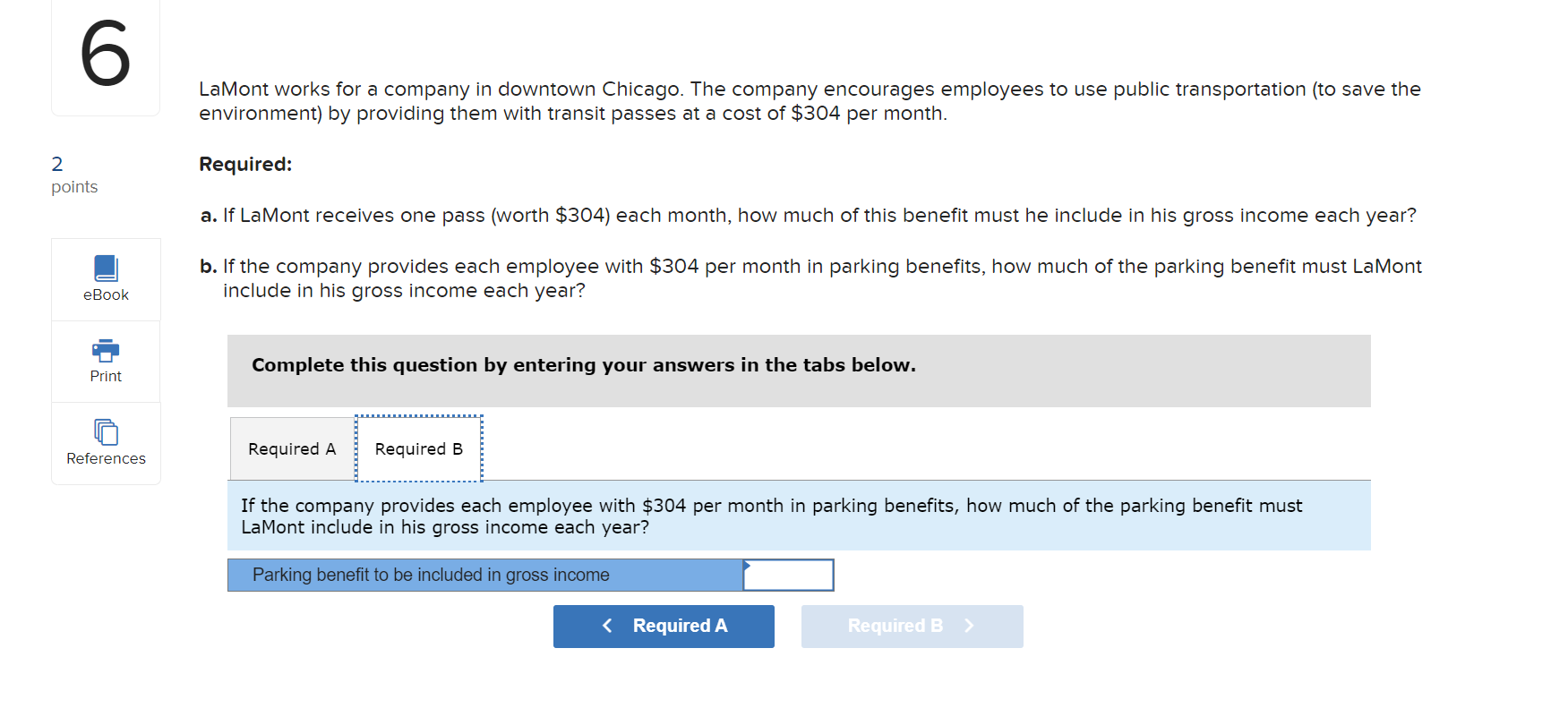

Question: 2 points eBook = Print D References LaMont works for a company in downtown Chicago. The company encourages employees to use public transportation (to save

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock