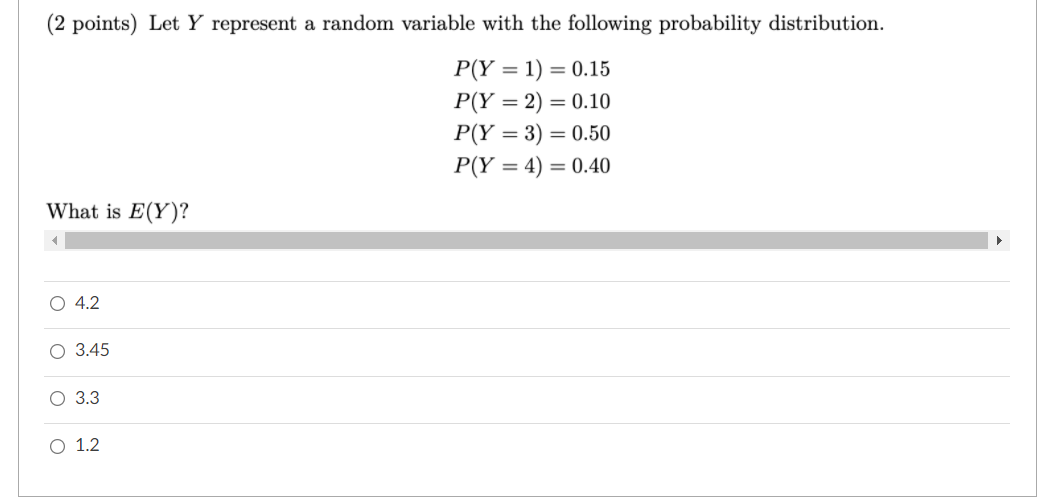

Question: (2 points) Let Y represent a. madam variable with the following probability distribution. P(Y = 1) = 0.15 P(Y = 2) = 0.10 P(Y =

![0.4 P(Y = 1) = 0.6 What is E[Y]? O 0.6 O](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eeeeca58544_73066eeeeca3fbdc.jpg)

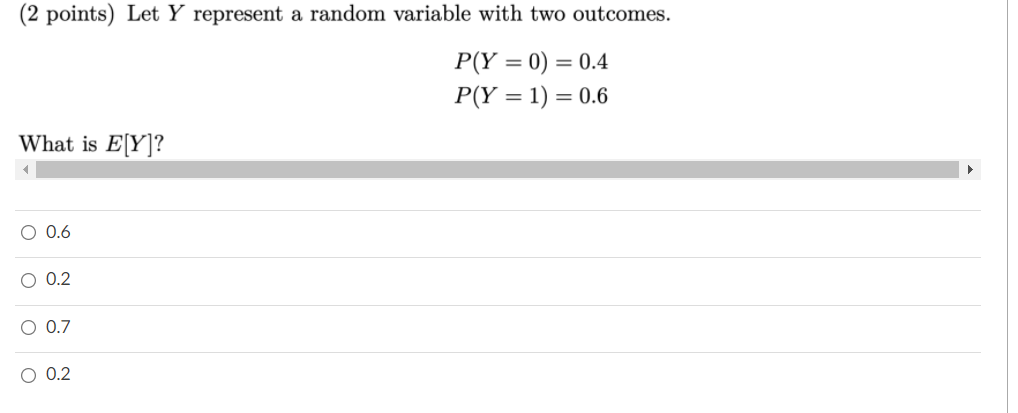

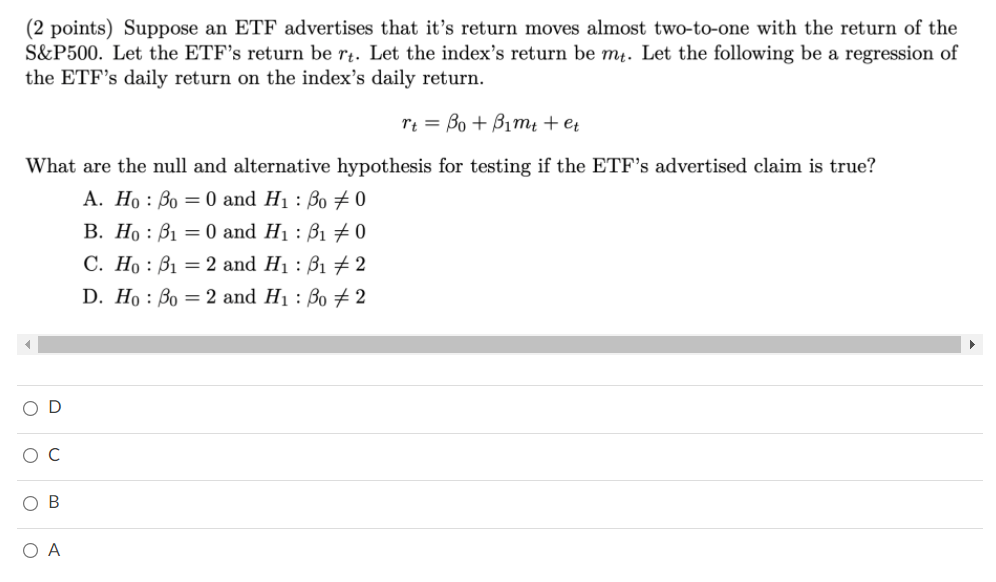

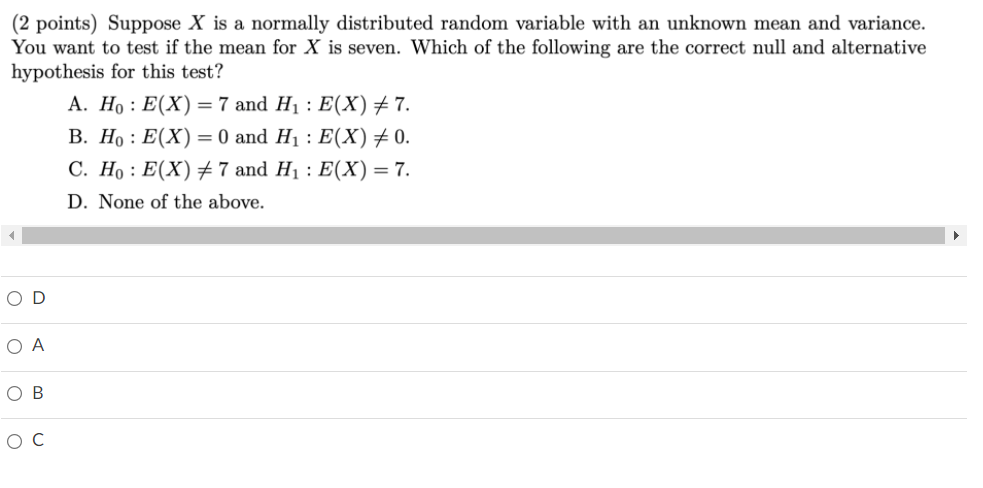

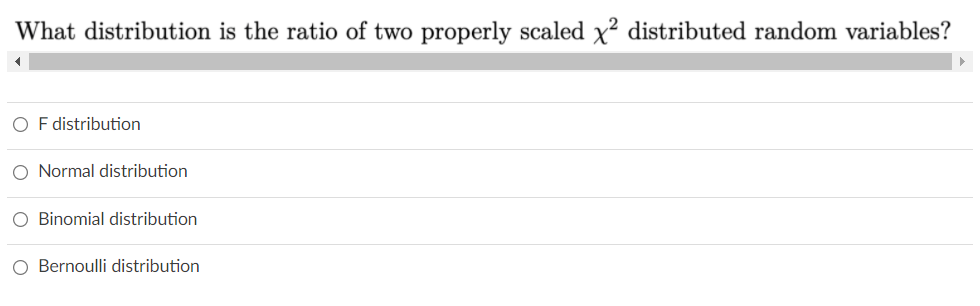

(2 points) Let Y represent a. madam variable with the following probability distribution. P(Y = 1) = 0.15 P(Y = 2) = 0.10 P(Y = 3) = 0.50 Par = 4) = 0.40 What is 50*)? 0 4.2 0 3.45 O 3.3 0 1.2 (2 points) Let Y represent a random variable with two outcomes. P(Y = 0) = 0.4 P(Y = 1) = 0.6 What is E[Y]? O 0.6 O 0.2 O 0.7 O 0.2(2 points) Suppose an ETF advertises that it's return moves almost two-to-one with the return of the S&P500. Let the ETF's return bert. Let the index's return be me. Let the following be a regression of the ETF's daily return on the index's daily return. Tt = Bo+ Bim+ + et What are the null and alternative hypothesis for testing if the ETF's advertised claim is true? A. Ho : Bo = 0 and H1 : Bo # 0 B. Ho : B1 = 0 and H1 : B1 # 0 C. Ho : B1 = 2 and H1 : B1 # 2 D. Ho : Bo = 2 and H1 : Bo # 2 OD OC O B O A(2 points) Suppose X is a normally distributed random variable with an unknown mean and variance. You want to test if the mean for X is seven. Which of the following are the correct null and alternative hypothesis for this test? A. Ho : E(X) = 7 and H1 : E(X) # 7. B. Ho : E(X) = 0 and H1 : E(X) # 0. C. Ho : E(X) # 7 and H1 : E(X) = 7. D. None of the above. OD O A O B OCWhat distribution is the ratio of two properly scaled x2 distributed random variables? OF distribution O Normal distribution O Binomial distribution O Bernoulli distribution(2 points) Suppose you are studying the determinants of mutual fund performance using a oommerically available database. Which of the following issues might prevent you from estimating regression slopes that are useful for causal inference? A. Some mutual funds' change their strategies. B. The worst performing mutual funds do not report their performance to the data vendor. C. Some mutual funds outperform the stock market. D. Seme mutual funds' managers change. '> 0C OB 0A OD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts