Question: 2 points SWEAT QUESTION 5 A project requiring an interment of 4020 offers the following cash low 1920 at t-1,2300 2 and 3740 The decision

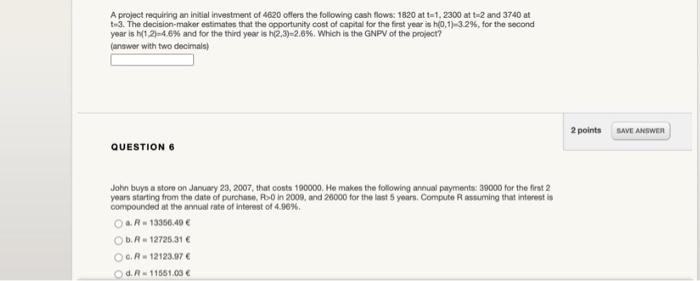

2 points SWEAT QUESTION 5 A project requiring an interment of 4020 offers the following cash low 1920 at t-1,2300 2 and 3740 The decision makerstimates that the opportunity cost of capital for the first year:32. for record years (124.0% and for the third year 20%Which the GNPV of the project answer with two deca pointe ANEWER QUESTION John buy or on January 23, 2007 cod 190000. te makes the following payment: 1000 for the first 2 years starting from the foon 2000, 2000 for the best SysComputing that compounded at the rate of tot 40% AR13066.40 12721 ORT d11551.00 A project requiring an initial investment of 4620 offers the following cash flows: 1820 at t=1.2300 at t-2 and 3740 at 3. The decision-maker estimates that the opportunity cost of capital for the first year is h(0, 1)-3.2%, for the second year is 12-46% and for the third year is h(2,3)-2.6%. Which is the GNPV of the project? (answer with two decimals) 2 points SAVE ANSWER QUESTION 6 Johin buys a store on January 23, 2007, that conta 100000. He makes the following annual payments: 39000 for the first 2 years starting from the date of purchase. Bin 2009, and 20000 for the last 5 years. Compute Rastuming that interest i compounded at the annual rates of interest of 4.90% a R-13366,40 DR 12725,31 GR-12123.97 d.R-11551.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts